Your credit score determines your financial liabilities and informs lenders, renters, and mortgage companies to evaluate how likely they may get their returns from you. If you’ve never had any problems getting a mortgage for your home, renting a nice home, or getting loans from a bank, then you’re one of the lucky ones.

Badcredit.org claims that around 16% of the entire population of the United States has low credit scores, which restricts them from receiving credit services. Many people with low credit scores are in the condition they are in because they have not paid enough attention to their credit scores.

Through TransUnion, anyone can track their credit score accurately and how to keep it high. The review you’re about to read is a TransUnion review made to inform you that this amazing credit scoring bureau is the perfect solution for anyone who may need to constantly monitor their credit score.

Check your credit score and start credit monitoring on the website >>

If you need to constantly monitor your credit score, this article is just for you. Keep reading this TransUnion review to know more about the service.

What is TransUnion?

TransUnion is one of the three most prominent credit-scoring bureaus in America. It is based in the UK and operational in 30 different countries. TransUnion constantly updates you on your credit and will send you notifications if anything changes in your credit score.

ID theft is one of the biggest issues for anyone with a credit score. TransUnion is perfect for keeping your credits safe from identity thieves. You can detect if someone has stolen your ID.

TransUnion is currently among the most favorite credit score bureau in the United States. The bureau will help to fix your credit scores for a low subscription price that literally anyone can afford. So basically, TransUnion will:

- Help you to monitor your credit score.

- Improve your credit score.

- It will give you updates about your credits.

- Keep your ID safe.

How does TransUnion work?

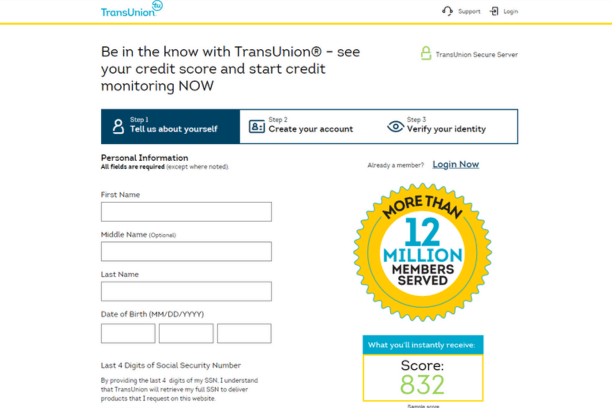

Using the TransUnion services won’t require you to download any extra software. You can still download the TransUnion app, but it’s not mandatory. You must sign up on the TransUnion website to get all your reports.

When you sign up for TransUnion, the bureau will monitor your credits. If anything regarding your credit score or the account changes, they will instantly alert you of any change to your TransUnion account to verify that you made the changes. TransUnion provides you the best security to prevent identity and credit theft through this monitoring method.

TransUnion uses the VantageScore credit scoring scale to determine your credit score. TransUnion and Equifax are different because TransUnion uses the VantageScore scale, and Equifax uses the FICO scale to determine their clients’ credit scores. On the VantageScore scale, a score of 661-780 is seen as a good score, and on FICO, 670 to 730 is a good credit score.

Just because the two bureaus use different scales to determine your credit score, it doesn’t mean one is better. But since each bureau calculates your credit scores differently, there may be some marginal discrepancies on different bureaus; you can always cross-check to see your credits for yourself.

The VantageScore scale determines your credit scores by calculating how much money you owe to different creditors. It calculates how many bills you have due, how many credits are unpaid, and how much you owe to other creditors.

Is TransUnion Good?

TransUnion is a very good, easy-to-use, accurate credit score bureau. Ever since I started paying my own bills, I’ve used TransUnion. I’m satisfied with their service because they receive constant updates on the TransUnion app. The TransUnion credit report comprehensively updates my credits and what I should do to boost my scores. Yes, a subscription costs a few bucks, but I think it’s worth it.

TransUnion sends all its subscribers an annual credit report. The TransUnion annual credit reports provide subscribers with all the year’s credit scores. Most people with low credit scores don’t monitor their credits as often as they should because they’re lazy or need to learn to track their scores. The TransUnion online services make it easy for anyone to open an account and monitor their credit score accurately.

The TransUnion auto insurance score system will let you boost your credit score so that insurance and any kind you need throughout your life.

Before writing this TransUnion review, I wanted to see how the other users of the credit score bureau feel about it. I have reviewed numerous user reviews of TransUnion and saw that most people who subscribe to it have good things to say. The negative reviews on the web mostly complain about the minor discrepancies they see when they compare their TransUnion score with other credit score bureaus. Some users see this as a negative because they must clearly understand the different scales used to measure credit scores.

The user satisfaction rate that we can see through real user reviews of TransUnion, we can again confirm that TransUnion really is one of the best credit score bureaus in the world.

What are the benefits of a TransUnion account?

Our financial freedom often depends on our credit score. No matter where you go in America, a good credit score is necessary to get financial services. Whether renting a house or buying a house, from getting a business loan to personal loans, the creditors will want to see your credit scores no matter where you go.

The TransUnion credit bureau is the best bet to improve your credit scores and qualify for financial services. The bureau will tell you everything you need to know about improving your credit scores and living free from financial burdens.

Below are some benefits you will enjoy by subscribing to TransUnion.

- Monitoring Your Credit Score: Your TransUnion account will give your constant updates on your credits. Through the TransUnion online account, you will know what your credit score is. You can also check if your credits are increasing. Suppose you notice that your credits are increasing without you even taking them. In that case, you can report a TransUnion breach and take steps to stop the breach while it happens.

- Security: TransUnion is the safest credit score bureau in the world. The bureau will instantly detect if someone’s using your credit card without your consent or trying to steal your identity.

- Fast Credit Reports: TransUnion is the fastest way to get your credit report. With TransUnion’s direct login through its app, you can see your credit report within minutes when needed.

- Resolve Credit Disputes: A credit dispute is when customers challenge their credit card debt. The TransUnion dispute inquiry will provide accurate information about your transactions and credits. Through the help of the TransUnion dispute inquiry, you can easily resolve your credit disputes.

- Monitor Public Records: You can monitor your public records and credit information through the TransUnion service. TransUnion will show you your public records so you can make future decisions accordingly.

- Monitor Bank Account: The TransUnion Bank monitoring feature allows you to monitor your bank account daily. You don’t have to visit your bank’s website and log into your account just to see what’s happening to your bank account. The TransUnion credit score bureau will monitor your bank account and credits.

>>Get your credit report and monitoring started ASAP.

TransUnion Pros and Cons

Now that you know the positives of subscribing to TransUnion, I want to show you the list of all the positives and negatives of subscribing to it. Through this list of pros and cons,s you will have a more concise idea of whaTransUnion offers and if there may be a better choice.

Pros:

- TransUnion allows you to access credit karma, MSM Credit Monitor, and TotallyMoney.

- The safest credit score bureau out there.

- Get over 1 million dollars in ID theft insurance.Toll-free fraud specialist hotline.

- Credit lock.

- Credit Compus feature.

- Very easy to navigate.

- Fast results.

- Better than other credit score bureaus.

- Match your loans and credits according to your credit scores.

- Manage your credit scores more efficiently.

Cons:

- There’s no live chat helpline.

- Since it provides you data from both Experian and Equifax, it costs a bit more than the other two.

- Institutions prioritizing the FICO scale instead of the VantageScore scale may reject your credit score.

How does TransUnion compare to other credit score bureaus?

Even though TransUnion is similar to any other credit score bureaus in the UK, I still want to compare the other two prominent bureaus.

- TransUnion VS Experian

Experian is one of the biggest and best credit score bureaus in the UK. the reasonExperiann stands apart from other credit score bureaus is because of its free features. You will only get some of the information you require from the free features because Experian only provides detailed information to those who buy a monthly subscription.

- TransUnion VS Equifax

Equifax is one of the largest social credit reference services in the UK. they work the same way as TransUnion but could be more user-friendly. The service requires a monthly fee. You can view your Equifax data on ClearScore; it works the same way as TransUnion and TotallyMoney.

How should I use TransUnion?

Among all credit score bureaus, TransUnion is the easiest to use. Sign up on the TransUnion website and let the system handle it. You will receive your first credit report when you sign up and after signing on the official site. Then, TransUnion will start monitoring your credits and keep updating you.

There are no hidden charges for subscribing to TransUnion, so you will receive all your important information for the price you sign up for. You will have the feature of freezing your TransUnion account. Suppose you get notified that someone’s trying to breach your TransUnion account. In that case, you can instantly freeze all transactions using the TransUnion account option.

TransUnion gives you everything you’ll need to maintain a good credit score on your dashboard.

How is TransUnion customer support?

You can contact the TransUnion customer support number on weekdays, 8 AM to 12 AM Eastern Time and 8 AM to 8 PM on the weekends.

You won’t need to contact customer support most of the time because you will find anything you need to know on the main site. But when, for some reason, you need help directly from TransUnion, you can always call the TransUnion contact number for all your queries.

Suppose you fall victim to fraud or identity theft; you can contact hotline fraud specialistsFraud Victim Assistance Department through their hotline. The hotline fraud specialists will quickly give you your identity and accounts.

How much does TransUnion cost?

TransUnion may be one of the cheapest options for getting your credit scores, and it’s definitely among the most legitimate ones. Through TransUnion, you will get access to your credit score projection from three different bureaus.

You must pay a small monthly subscription fee of $24.95 to get your report from TransUnion. But if you want your credit reports for 3 bureaus, you will have to pay a subscription fee of $29.95.

When you sign up on TransUnion, you will be eligible for all the perks that TransUnion has to offer.

>>Get your credit report and monitoring started ASAP.

TransUnion Reviews

As I said before, to ensure I am not biased while writing this review, I have gone through many user reviews of TransUnion from different websites to ensure it is as good as I think.

While going through the reviews, I found that-

- Among 41 reviews of TransUnion on Trustpilot, the majority have reviewed the bureau to be quite satisfactory.

- Around 1000 users have shared their thoughts about TransUnion on Glassdoor; most have reviewed it as a 4-star service out of 5.

- Over 2000 people have shared their review of TransUnion on ConsumerAffairs, and most have reviewed it favorably, with over 4 out of 5 stars.

- And lastly, I found that 181 people had shared their TransUnion review on Ambitionbox, and they gave it 4 stars out of 5.

TransUnion Review: Conclusion

To live without financial burdens, you must keep your credit scores high. The best course of action for credit scores is to pay back your creditors and have a manageable amount of outstanding credit. But it’s also true that keeping a good credit score is more challenging than in our modern age. We need to borrow money to either keep our businesses running or to keep a roof over our heads.

In this TransUnion review, I have shown you how this amazing to track your credits and improve TransUnion credit score bureau is the most trusted and efficient way of keeping track of your credits and improving your credit scores.

TransUnion FAQ

Is TransUnion legit?

TransUnion is among the top 3 credit score bureaus in the world. There are millions of people taking financial services from TransUnion. It is also among the world’s most recognized credit score bureaus. Yes, TransUnion is legit.

Can I get a home loan if TransUnion values my credit score to be high?

Yes, you can apply for a housing loan from creditors if you have a good credit score on TransUnion.

Where is TransUnion based?

The TransUnion credit bureau is based in the United Kingdom. Even though it’s based in Europe, it is one of America’s most popular credit score bureaus.

Also Read: SightCare Review

buy lanoxin online cheap buy molnunat 200mg sale molnunat online buy

Meds information for patients. Cautions.

nexium without rx

Some information about drug. Get information here.

finasteride allergy! [url=http://propeciap.tech/]finasteride discussions[/url] very good internet site http://propeciap.tech

There is definately a lot to find out about this subject. I like all the points you made

Thank you for great content. I look forward to the continuation.

Greetings! Very helpful advice in this particular article! It is the little changes which will make the most important changes. Thanks a lot for sharing!

Good post! We will be linking to this particularly great post on our site. Keep up the great writing

Very nice blog post. I definitely love this site. Stick with it! .

A big thank you for your blog.Really looking forward to read more. Want more.

Very nice blog post. I definitely love this site. Stick with it!

Hi there to all for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff. i want newsmax.com live

Very well presented. Every quote was awesome and thanks for sharing the content. Keep sharing and keep motivating others.

Thank you for great article. I look forward to the continuation.

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

I very delighted to find this internet site on bing just what I was searching for as well saved to fav Watch bbcpersian com

I really like reading through a post that can make men and women think. Also thank you for allowing me to comment!

I m going to bookmark your web site and maintain checking for brand spanking new information.

I truly appreciate your technique of writing a blog. I added it to my bookmark site list and will