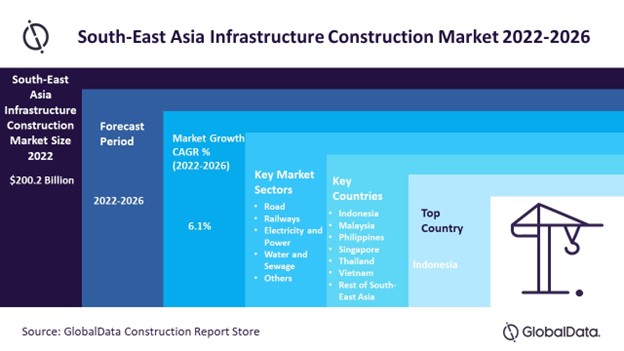

South-East Asia infrastructure construction market size was evaluated at $200.2 billion in 2022, according to a new report by GlobalData Plc. Factors such as evolving demand-positive demographics, rising household incomes, and continuing urbanization will support demand for new road construction and improvements in the long term.

Read our free sample for South-East Asia infrastructure construction market forecasts

South-East Asia Infrastructure Construction Market FAQs

- What was the South-East Asia infrastructure construction market size in 2022?

The South-East Asia infrastructure construction market was valued at $200.2 billion in 2022.

- What is the South-East Asia infrastructure construction market growth rate during 2023-2026?

The South-East Asia infrastructure construction market will grow at 6.1% during 2023-2026. - Which are the key sectors of South-East Asia infrastructure construction market?

The key sectors of South-East Asia infrastructure construction market are electricity and power, railway, road, water and sewage, and others. - Which are the key countries in the South-East Asia infrastructure construction market?

Indonesia, Malaysia, Thailand, Singapore, Philippines, and Vietnam are the key countries in the South-East Asia infrastructure construction market. - Which country showcased the highest South-East Asia infrastructure construction market growth in 2022?

Indonesia showcased the highest share of the South-East Asia infrastructure construction market growth in 2022.

For more queries on the South-East Asia infrastructure market, get free report sample

South-East Asia Infrastructure Construction Market Dynamics

The regional dynamics over the forecast period are expected to be driven by countries including Indonesia, Malaysia, Philippines, Thailand, and Vietnam. These countries captured a share of more than 82.0% in terms of project pipeline value. Among these, Vietnam is expected to register 29.3% of the regional pipeline value, followed by Indonesia at 20.4%, Philippines at 14.6% and Malaysia at 6.8%.

Most of the infrastructure construction projects in the top revenue-generating economies are supported by government investments and funding to strengthen the existing infrastructure while providing sustainable resources for the upcoming construction projects. For instance, the infrastructure sector in Philippines is supported by the government’s plan to improve regional connectivity through the development of transport infrastructure. Similarly, the infrastructure construction sector of Indonesia will be supported by government investment on transport projects to improve regional connectivity.

Learn about the South-East Asia infrastructure construction market dynamics by viewing report sample right here!

South-East Asia Infrastructure Construction Report Highlights

- The South-East Asia infrastructure construction market is projected to grow at a compounded annual growth rate of 6.1% over the forecast period. The urgent drive to upgrade the regional infrastructure to meet the growing needs of rising population is anticipated to drive the market growth over the predicted timeline.

- The roads segment is projected to dominate the regional market share in terms of construction output value in 2021. Indonesia is projected to remain the front runner in the upcoming roadway related works over the forecast period.

- The railways are anticipated to showcase a compounded annual growth rate of nearly 6.3% over the forecast period primarily fueled by the significant volume of metro, tube and light rail developments in the region.

- The electricity and power segment is predicted to occupy a regional share of more than 22.0% in 2021. The drive towards transitioning to renewable sources of energy is likely to generate prospects of development over the forecast period.

- Indonesia is estimated to remain a dominant regional force with a share of more than 62.0% in 2021. The local government’s focus towards development of new capital city and the required supporting infrastructure is expected to positively aid the growth over the near future.

- Vietnam is predicted to showcase a compounded annual growth rate of 8.7% over the forecast period. The government’s focus on the transportation sector is estimated to drive the initiatives for road development works. For instance, the construction of Ho Chi Minh City’s 454km of transport infrastructure by 2025 at a total cost of VND266 trillion ($11.4 billion).

- Singapore is evaluated to occupy a regional share of 2.0% in terms of construction output value in 2021. The highest-value project in the pipeline is Singapore’s $29 billion Cross Island MRT development. The development involves the construction of a 50km MRT line from Changi to Jurong Industrial estate, and the construction of 30 stations.

- Philippines is estimated to emerge with fastest annual average growth rate of 7.1% from 2023 to 2026. Most substantial of these developments is the $7.1 billion Metro Manila Subway Line 9 project, on which, construction began in the first quarter of 2019. The project is part of the President Marcos Jr’s Build, Better, More program, and is the first phase of the first phase of the “Mega Manila Subway Project”. Once operational, by the end of 2028, line 9 will be capable of handling 1.5 million passengers per day, easing traffic congestion in Metro Manila.

Request a sample report PDF for additional South-East Asia infrastructure construction highlights

South-East Asia Infrastructure Construction Market Segmentation

South-East Asia Infrastructure Construction Sectors Outlook (Value, $ Billion, 2016-2026)

- Electricity and Power

- Railway

- Road

- Water and Sewage

- Others

South-East Asia Infrastructure Construction Countries Outlook (Value, $ Billion, 2016-2026)

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of South-East Asia

For more segment-specific insights and scope coverage, download a free sample report

Related Reports

- Infrastructure Market Size, Trends and Growth Forecast by Key Regions and Countries, 2021-2026

- Singapore Construction Market Size, Trend Analysis by Sector (Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential) and Forecast, 2023-2027

- Vietnam Construction Market Size, Trends and Forecasts by Sector – Commercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential Market Analysis, 2022-2026

TOC

1 Overview

2 Sector Overviews

2.1 Railways

2.2 Roads

2.3 Electricity and Power

2.4 Water and Sewage

2.5 Others

3 Project Pipelines

3.1 All Infrastructure Projects

3.1.1 Railway Projects

3.1.2 Road Projects

3.1.3 Electricity and Power Projects

3.1.4 Water and Sewage Projects

3.1.5 Other Projects

4 South-East Asia Infrastructure Construction Regional Trends

4.1 South-East Asia Infrastructure Construction Market Data

4.1.1 Indonesia Infrastructure Construction Market Data

4.1.2 Malaysia Infrastructure Construction Market Data

4.1.3 Philippines Infrastructure Construction Market Data

4.1.4 Singapore Infrastructure Construction Market Data

4.1.5 Thailand Infrastructure Construction Market Data

4.1.6 Vietnam Infrastructure Construction Market Data

4.1.7 Rest of South-East Asia Infrastructure Construction Market Data

5 Research Methodology

5.1 Introduction

5.2 Research Methodology Steps

5.2.1 Data Collection and Consolidation

5.2.2 Modelling and Estimation

5.2.3 Forecasting and Validation

About GlobalData

GlobalData is a leading provider of data, analytics, and insights on the world’s largest industries. In an increasingly fast-moving, complex, and uncertain world, it has never been harder for organizations and decision-makers to predict and navigate the future. GlobalData’s mission is to help our clients to decode the future and profit from faster, more informed decisions. As a leading information services company, thousands of clients rely on us for trusted, timely, and actionable intelligence. Our solutions are designed to provide a daily edge to professionals within corporations, financial institutions, professional services, and government agencies.

Contact Information:

Media Contacts GlobalData Mark Jephcott Head of PR EMEA [email protected] cc: [email protected] +44 (0)207 936 6400

Tags:

PR-Wirein, Reportedtimes, iCN Internal Distribution, Extended Distribution, Research Newswire, English