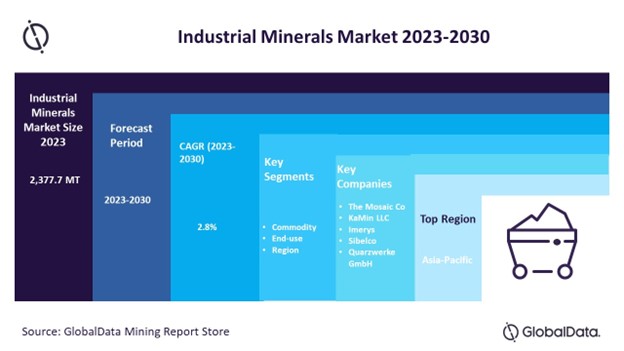

According to a new report by GlobalData Plc, the global industrial minerals market size was valued at 2,377.7 million tonnes in 2023. These industrial minerals are expected to play a pivoting role in the development of sustainable or clean energy technologies over the forecast period.

Industrial minerals market outlook report with detailed commodity and end-use category segment analysis is available with GlobalData Now, Read our Free Sample Report

Industrial Minerals Market FAQs

- What will be the industrial minerals market size in 2023?

The industrial minerals market size globally will reach 2,377.7 Million Tonnes in 2023.

- What is the industrial minerals market growth rate?

The industrial minerals market is expected to grow at a CAGR of 2.8% over the forecast period (2023-2030).

- What are the key industrial minerals market drivers?

The expansion of the construction sector with a focus on infrastructural development and the growing chemical manufacturing vertical are anticipated to remain key drivers for industrial minerals market growth over the forecast period.

- What are the key industrial minerals market segments?

Commodity Segments: Barite, Bentonite, Boron, Diatomite, Dolomite, Feldspar, Fluorspar, Graphite, Gypsum and Anhydrite, Kaolin, Limestone, Phosphate Rock, Potash, and Salt

End-Use Segments: Construction & Material, Chemical, Ceramic & Glass, and Others

- Which are the leading industrial minerals companies?

The leading industrial minerals companies are The Mosaic Co, KaMin LLC, Imerys, Sibelco, Quarzwerke GmbH, Thiele Kaolin Company, I-Minerals Inc., Gypsum Resources Materials, Ashapura Group, Clariant, Ma’aden, Omya AG, Minerals Technologies Inc., Vulcan Materials Company, and CRH Americas Materials, Inc.

For more queries on the industrial minerals market, view report sample report

Industrial Minerals Market Dynamics

The high volume and low cost of industrial minerals support their uses across key end-use sectors including construction & material, chemical, ceramic & glass, and others. Among these, the ceramic sector particularly in the Europe region is severely affected due to the ongoing Russia-Ukraine conflict. Ukraine’s Donbas region is the key source for the supply of ceramic minerals to Europe and has reported a disastrous impact on its mining operation coupled with blockages of port facilities. The prolongation of this ongoing conflict is anticipated to directly hamper the ceramics industry operations across Spain, Italy, Turkey, and Poland.

Learn about the industrial minerals market dynamics by downloading report sample right here!

Industrial Minerals Market Report Highlights

- The global industrial minerals market is anticipated to reach a volumetric demand of more than 2.90 Billion Tonnes by 2030, registering a compounded annual growth rate (CAGR) of 2.8% over the forecast period. The expansion in construction activities with a concentrated focus on infrastructural developments is projected to positively influence the market growth over the short-term period.

- Among the commodity segment, limestone accounted for a significant share in 2022. Limestone usage from primary road base material to high-end processed material for the cosmetics sector is likely to drive segmental growth over the forecast period.

- Graphite is estimated to showcase the fastest compounded annual growth rate (CAGR) of 4.5% over the predicted timeline. The increasing prominence of this mineral group in the electric vehicle battery sector is anticipated to support its growth over the near future.

- Construction & material is poised to remain the fastest growing and largest end-use segment of the global industrial minerals market over the forecast period. Industrial minerals with high volume and low-cost characteristics find their usage across different verticals of global construction & material domain. This end-use segment was responsible for more than half of the demand within the global market space in 2022.

- The chemical sector was the second largest end-use segment in 2022 accounting for nearly one-third of the volumetric demand at a global level. The continuous evolution of the chemical sector with innovative products supporting the global masses is expected to fuel the demand for different mineral groups over the coming years.

- Asia-Pacific region dominated this market space primarily driven by India and China which are among the leading spenders and developers of infrastructure projects in their respective countries.

- North America region registered the second-largest share in 2022, registering a compounded annual growth rate (CAGR) of 2.5% over the forecast period. Regional growth is heavily influenced by the dynamics of the US construction and chemical sector.

- Europe remained the third largest region in 2022 with a shrinking market share. The regional growth is expected to remain the slowest as compared to its counterparts owing to the ongoing Russia-Ukraine conflict.

- The key industrial minerals market vendors analyzed as part of this report include The Mosaic Co, KaMin LLC, Imerys, Sibelco, Quarzwerke GmbH, I-Minerals Inc., Ashapura Group, Thiele Kaolin Company, Gypsum Resource Materials, Vulcan Materials Company, CRH Americas Materials, Inc., among others.

Unlock additional market dynamics impacting the industrial minerals market growth by requesting a sample PDF

Industrial Minerals Market Scope

GlobalData Plc has segmented the industrial minerals market report by commodity, end-use, and region:

Global Industrial Minerals Commodity Outlook (Volume, Thousand Tonnes, 2020-2030)

-

- Barite

- Bentonite

- Boron

- Diatomite

- Dolomite

- Feldspar

- Fluorspar

- Graphite

- Gypsum and Anhydrite

- Kaolin

- Limestone

- Phosphate Rock

- Potash

- Salt

Global Industrial Minerals End-Use Outlook (Volume, Thousand Tonnes, 2020-2030)

-

- Construction & Material

- Chemical

- Ceramic & Glass

- Others

Global Industrial Minerals Regional Outlook (Volume, Thousand Tonnes, 2020-2030)

- North America

-

- U.S.

- Canada

- Europe

-

- Germany

- France

- UK

- Spain

- Russia

- Rest of Europe

- Asia Pacific

-

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

- South & Central America

-

- Brazil

- Rest of South & Central America

- Middle East & Africa

-

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Know more about each segment and regional opportunities, download sample now!

Related Reports

- Lithium Mining Market by Reserves and Production, Assets and Projects, Demand Drivers, Key Players and Forecast to 2030

- Cobalt Mining Market Analysis including Reserves, Production, Operating, Developing and Exploration Assets, Demand Drivers, Key Players and Forecasts, 2021-2030

- Graphite Mining Market by Reserves and Production, Assets and Projects, Demand Drivers, Key Players and Forecast, 2022-2026

About us

GlobalData is a leading provider of data, analytics, and insights on the world’s largest industries. In an increasingly fast-moving, complex, and uncertain world, it has never been harder for organizations and decision-makers to predict and navigate the future. GlobalData’s mission is to help our clients to decode the future and profit from faster, more informed decisions. As a leading information services company, thousands of clients rely on us for trusted, timely, and actionable intelligence. Our solutions are designed to provide a daily edge to professionals within corporations, financial institutions, professional services, and government agencies.

Contact Information:

GlobalData Mark Jephcott Head of PR EMEA [email protected] cc: [email protected] +44 (0)207 936 6400

Tags:

Reportedtimes, iCN Internal Distribution, Extended Distribution, Research Newswire, English