Debt can be a major source of stress for many people, and this stress can have serious effects on both the body and the mind. When you’re struggling with debt, it can be hard to relax and enjoy life, and the constant worry and stress can take a toll on your physical and emotional well-being. In this article, we’ll explore how debt-related stress affects body and mind and what you can do to find relief.

Effects of Debt-Related Stress

One of the most common physical symptoms of debt-related stress is insomnia. If you’re constantly worrying about how you’re going to pay your bills or meet your financial obligations, it can be difficult to fall asleep or stay asleep. This lack of sleep can then lead to other physical problems, such as fatigue, irritability, and a weakened immune system.

Another common physical symptom of debt stress is stomach problems. The stomach is often called the “second brain,” and it’s no surprise that stress can cause digestive issues like indigestion, heartburn, and stomach aches. Debt-related stress can also lead to changes in appetite, causing some people to eat more or less than they normally would.

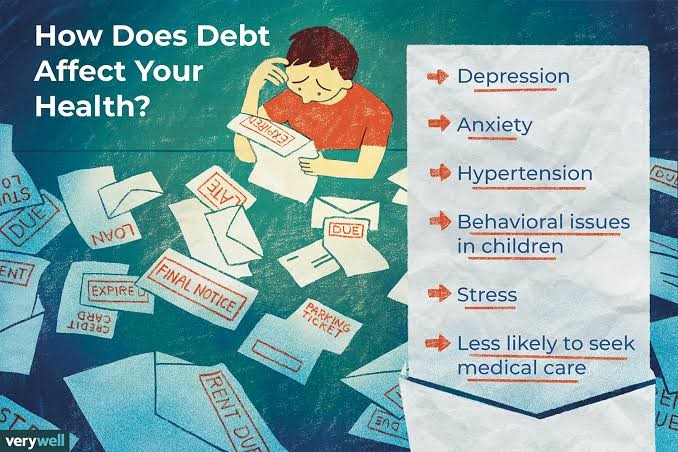

In addition to physical symptoms, debt-related stress can also have a negative impact on your mental health. It’s not uncommon for people struggling with debt to feel overwhelmed, anxious, and depressed. These negative emotions can then affect your relationships with loved ones, as you may be more prone to arguments and conflicts.

One of the biggest impacts of debt-related stress is the effect it can have on your overall quality of life. When you’re constantly worried about how you’re going to pay your bills or meet your financial obligations, it can be hard to enjoy the things you love and find happiness in your daily life. Debt stress can also impact your relationships, causing tension and conflict with loved ones who may not understand the full extent of your financial struggles.

How to Relieve Debt-Related Stress

It’s important to recognize the signs of debt-related stress and take steps to address it before it becomes overwhelming. This may involve seeking professional help through a debt relief program or seeking support from friends and family. It’s also a good idea to prioritize self-care and make time for activities that bring you joy and relaxation. By taking care of yourself and finding ways to manage your stress, you can work towards financial freedom and a healthier, more balanced life.

Another way to reduce debt-related stress is to develop a budget and stick to it. This can help you get a better handle on your finances and feel more in control of your situation. It’s also a good idea to seek support from friends, family, or a therapist if you’re feeling overwhelmed.

Finally, try to take care of yourself and make time for activities that bring you joy. This could be anything from exercise and hobbies to spending time with loved ones. Taking care of your physical and emotional well-being can help you better cope with the stress of debt.

There are many ways how debt-related stress affects body and mind, such as causing physical symptoms, as well as negative effects on mental health, relationships, and overall quality of life. It is important to recognize the signs of debt-related stress and take steps to address it, such as seeking professional help, developing a budget, and making time for activities that bring joy. By taking control of your finances and taking care of yourself, you can work towards financial freedom and a more balanced life.