In an era where environmental concerns are no longer relegated to the sidelines but have taken center stage, industries worldwide are undergoing a paradigm shift toward sustainable practices. Among the myriad ways this shift is manifesting, the intersection of finance and sustainability is particularly intriguing.

One emerging trend within this intersection is the amalgamation of “Green Finance ” principles with the digitization of paystubs maker, a seemingly small yet impactful innovation that has the potential to revolutionize the way businesses operate and contribute to a more eco-friendly future.

Green Finance: A Primer

Green Finance, often interchangeably referred to as sustainable finance, represents a novel approach that marries financial decisions with environmental, social, and governance (ESG) considerations. The primary goal of Green Finance is to channel investments and financial resources toward activities that promote sustainability and create positive environmental impacts.

Traditionally, this has been realized through eco-friendly investments and projects. However, the concept has transcended the realm of investment portfolios and is making its way into day-to-day financial operations, including the management of employee pay.

The Digital Evolution of Paystubs

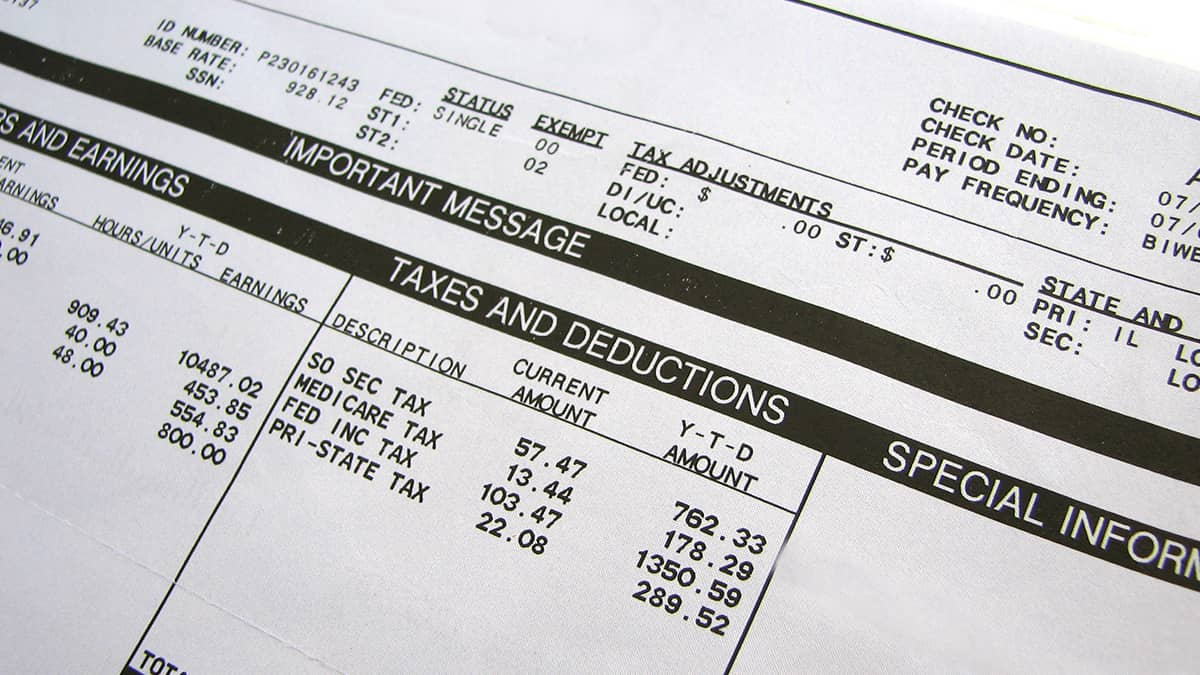

For years, paper paystubs were the norm – a tangible representation of an employee’s compensation, taxes, and deductions. However, with the advent of digital technology, a significant transformation is underway.

Digital paystubs, also known as e-paystubs or electronic paystubs, are gaining traction as an efficient and environmentally conscious alternative to their paper counterparts. These electronic versions allow employees to access their pay information online, anytime, anywhere, replacing the need for physical documents.

Greening the Financial Process: How Digital Paystubs Contribute

The convergence of Green Finance principles with digital paystubs is a compelling example of how innovation can synergize with environmental responsibility. Here’s how these two seemingly disparate elements intertwine to forge a path toward eco-friendly financial operations:

- Reduced Carbon Footprint: The move from paper to digital paystubs is accompanied by a marked reduction in paper usage. This directly translates to fewer trees being cut down, lower energy consumption for paper production, and reduced greenhouse gas emissions associated with the transportation and disposal of paper documents.

- Minimized Resource Consumption: The paper production process demands copious amounts of water, energy, and chemicals. By transitioning to digital paystubs, businesses contribute to conserving these valuable resources, thus aiding in the overall preservation of the environment.

- Financial Efficiency: Green Finance often entails optimizing financial processes to eliminate waste and inefficiency. The adoption of digital paystubs aligns seamlessly with this principle, as it streamlines payroll operations, minimizes administrative burdens, and ultimately saves time and money.

- Transparency and Accountability: A cornerstone of Green Finance is transparency. Digital paystubs enable employees to access their financial information directly, fostering trust and enhancing accountability in payroll processes.

- The catalyst for Behavioral Change: Incorporating eco-friendly practices within the workplace, such as digital paystubs, can serve as a catalyst for broader behavioral change. When employees witness their organization’s commitment to sustainability, it can inspire them to adopt similar practices in their personal lives.

Overcoming Challenges and Navigating the Future

While the fusion of Green Finance and digital paystubs holds tremendous promise, it is not without challenges. Ensuring data security and privacy is paramount, given the sensitive nature of payroll information. Additionally, addressing the digital divide – the gap between those with access to digital technology and those without – is essential to avoid inadvertently excluding certain segments of the workforce.

Looking forward, technology will undoubtedly play a pivotal role. The integration of blockchain technology, for instance, could enhance data security and integrity, further bolstering the appeal of digital paystubs. Furthermore, the growing momentum behind sustainable finance is likely to encourage more businesses to explore and embrace innovative, eco-friendly financial practices, further propelling the adoption of digital paystub solutions.

In Conclusion

The fusion of Green Finance and digital paystubs is emblematic of a broader societal shift towards conscious, sustainable business practices. While it may seem like a modest step, the transition from paper paystubs to digital counterparts embodies the larger philosophy of minimizing environmental impact while optimizing financial operations.

As more organizations recognize the interplay between fiscal responsibility and ecological well-being, the journey towards pioneering eco-friendly financial operations gains momentum, inching us closer to a future where economic success and environmental stewardship harmoniously coexist.

order vantin without prescription order flixotide online cheap flixotide sale

valcivir over the counter order generic valcivir 1000mg purchase ofloxacin pills

order cefpodoxime online cheap buy theo-24 Cr 400mg order flixotide online

buy valaciclovir without a prescription floxin 400mg cost purchase ofloxacin online

very satisfying in terms of information thank you very much.

I think the admin of this site is really working hard for his website since here every stuff is quality based data.

Hi there to all for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

You have noted very interesting details! ps decent web site.

it’s awesome article. I look forward to the continuation.

very satisfying in terms of information thank you very much.

Some really excellent info I look forward to the continuation.

Good post! We will be linking to this particularly great post on our site. Keep up the great writing

it’s awesome article. I look forward to the continuation.

Very well presented. Every quote was awesome and thanks for sharing the content. Keep sharing and keep motivating others.

This is really interesting You re a very skilled blogger. I ve joined your feed and look forward to seeking more of your magnificent post.

Thank you for starting this up. This website is something that is needed on the internet someone with a little originality!

natural cure for ed: canadian drugs gate – medications online

can we buy amoxcillin 500mg on ebay without prescription http://prednisoneraypharm.com/# prednisone drug costs

dapoxetine online: priligy max pharm – buy priligy

amoxicillin 500mg price in canada amoxil buy amoxicillin without prescription

how much is amoxicillin: Amoxicillin for sale – amoxicillin for sale online

amoxicillin generic http://prednisoneraypharm.com/# prednisone steroids

where can i buy prednisone without prescription raypharm cheap prednisone 20 mg

amoxicillin no prescription https://prednisoneraypharm.com/# prednisone 20

where can you get amoxicillin: Com Pharm – buy amoxicillin over the counter uk

prednisone uk buy: order Prednisone – 5 mg prednisone daily

cheap priligy buy priligy max pharm dapoxetine price

buy dapoxetine online: priligy max pharm – cheap priligy

buy priligy: buy dapoxetine online – priligy max pharm

how much is prednisone 10 mg: cheap prednisone – prednisone buy canada

get cheap clomid for sale: rex pharm – get cheap clomid without dr prescription

generic amoxicillin cost: cheap amoxil – amoxicillin no prescription

buy dapoxetine online: priligy – buy priligy

buy priligy: buy priligy max pharm – buy dapoxetine online

amoxicillin for sale online: buy amoxil online – amoxicillin for sale online

cheap priligy: priligy – priligy maxpharm

buy prednisone online australia: buy prednisone – prednisone best price

prednisone without a prescription: Prednisone Without Prescription – prednisone rx coupon

pharmacies in mexico that ship to usa http://mexicanpharmgate.com/ purple pharmacy mexico price list

Priligy tablets: Priligy tablets – cheap priligy

buy Lisinopril 1st cheapest Lisinopril lisinopril tabs 4mg

mexican drugstore online https://mexicanpharmgate.com/ mexican mail order pharmacies

minocycline: buy Ivermectin online – stromectol for head lice

order clomid tablets: clomid online – can i get clomid without prescription

http://iverfast.com/# stromectol xl

buy Lisinopril online lisinopril1st buy Lisinopril online

Lisinopril 1st: lisinopril tablet 40 mg – cheapest Lisinopril

prednisone where can i buy: cheap prednisone – can i buy prednisone online without prescription

https://plavixclo.com/# antiplatelet drug

Plavix generic price: buy Plavix Clo – Clopidogrel 75 MG price

prednisone 10mg cost: prednisone ray pharm – prednisone 5mg over the counter

cheapest Lisinopril buy Lisinopril 1st lisinopril1st

minocycline 100 mg tablets online: iver fast – п»їwhere to buy stromectol online

http://iverfast.com/# purchase oral ivermectin

priligy maxpharm: dapoxetine online – dapoxetine price

cheap priligy: max pharm – max pharm

https://cytpremium.com/# buy cytotec over the counter

pinup: пинап казино – пин ап казино онлайн

вавада онлайн казино vavada kazi vavada

пин ап кз: пин ап кз – пин ап казино

pinup: пин ап кз – pinup

pinup kazi: pinup – пин ап казино

пин ап казино онлайн: pinup – pin up казино

http://pinup-kazi.kz/# пин ап кз

vavada: вавада казино зеркало – vavada kazi

пин ап казино официальный сайт: pinup-kazi.ru – пин ап вход

вавада vavada-kazi.ru казино вавада

вавада онлайн казино: vavada-kazi.ru – вавада онлайн казино

пин ап казино онлайн: pinup-kazi.kz – pin up казино

pinup-kazi.ru: pinup – пин ап казино

http://pinup-kazi.ru/# пин ап казино

pinup kazi: пин ап казино – пин ап вход

pin up казино: пин ап казино – пин ап казино онлайн

pinup pinup-kazi.kz пин ап кз

пин ап казино официальный сайт: пинап казино – пин ап казино официальный сайт

пин ап кз: пин ап казино – pinup kazi

vavada kazi вавада казино vavada kazi

ed symptoms https://mexicanpharmeasy.com/# buying from online mexican pharmacy

buy medicines online in india indian pharm star mail order pharmacy india

online pharmacy india: IndianPharmStar.com – buy prescription drugs from india

ed drug prices: canada pharmacy online – drug medication

prescription meds without the prescriptions: canadianpharm1st.com – ed therapy

best otc ed pills: canadianpharm1st – best erection pills

buy online pharmacy http://indianpharmstar.com/# buy medicines online in india

medicines for ed: canadian pharm 1st – ed pills otc

indian pharmacy paypal: indian pharmacy – top 10 online pharmacy in india

natural cure for ed: canadian pharm – ed medications online

ed causes and treatment canadian pharm 1st ed treatment options

indian pharmacy online: IndianPharmStar – indian pharmacy paypal

ed aids http://mexicanpharmeasy.com/# medicine in mexico pharmacies

reputable indian pharmacies: IndianPharmStar.com – india online pharmacy

medicine for erectile: canadianpharm1st – cat antibiotics without pet prescription

Online medicine home delivery indian pharm top online pharmacy india

Online medicine order: indian pharm star – india pharmacy

natural ed pills https://canadianpharm1st.com/# ed pills comparison

indian pharmacy paypal: indian pharm – buy prescription drugs from india

indian pharmacy online: indian pharm – indian pharmacy online

ed causes and cures: canadian pharm – ed medications over the counter

best india pharmacy indian pharm star world pharmacy india

what type of medicine is prescribed for allergies http://canadianpharm1st.com/# erectile dysfunction pills

mexican mail order pharmacies: MexicanPharmEasy – medicine in mexico pharmacies

reputable indian online pharmacy: indian pharm – indian pharmacy online

best price for generic viagra on the internet canadian pharm pharmacy drugs

Online medicine home delivery: IndianPharmStar.com – buy medicines online in india

ed medications https://canadianpharm1st.com/# ed for men

buying prescription drugs in mexico online: mexican pharm easy – mexican drugstore online

mexico drug stores pharmacies: mexicanpharmeasy.com – mexican online pharmacies prescription drugs

over the counter ed: canada pharmacy online – over the counter ed medication

male enhancement products canadian pharmacy medications online

diabetes and ed https://canadianpharm1st.com/# cheap medication

mexican drugstore online: mexican pharm easy – mexico drug stores pharmacies

ed natural treatment: canadian pharm 1st – cheap pet meds without vet prescription

cheapest ed pills https://indianpharmstar.com/# top 10 pharmacies in india

best online pharmacies in mexico mexicanpharmeasy.com п»їbest mexican online pharmacies

india pharmacy: IndianPharmStar.com – Online medicine order

medications list: canadian pharm 1st – how to get prescription drugs without doctor

https://gabapentinpharm.com/# ordering neurontin online

AmoxilPharm: Amoxil Pharm Store – AmoxilPharm

Amoxil Pharm Store: AmoxilPharm – AmoxilPharm

Gabapentin Pharm: Gabapentin Pharm – Gabapentin Pharm

https://paxlovid.ink/# Paxlovid.ink

amoxicillin canada price amoxicillin 500 mg capsule Amoxil Pharm Store

buy amoxicillin 500mg capsules uk: AmoxilPharm – Amoxil Pharm Store

Ivermectin Pharm Store: Ivermectin Pharm Store – cost of ivermectin lotion

http://gabapentinpharm.com/# neurontin 800

buy semaglutide online: rybelsus cost – Rybelsus 7mg

Paxlovid buy online: Paxlovid.ink – Paxlovid.ink

how to get neurontin cheap: Gabapentin Pharm – Gabapentin Pharm

http://paxlovid.ink/# Paxlovid.ink

п»їpaxlovid: Paxlovid over the counter – buy paxlovid online

Gabapentin Pharm: Gabapentin Pharm – Gabapentin Pharm

http://gabapentinpharm.com/# neurontin pills

Amoxil Pharm Store: Amoxil Pharm Store – Amoxil Pharm Store

order minocycline 50 mg Ivermectin Pharm Store Ivermectin Pharm Store

https://amoxilpharm.store/# buy amoxicillin online without prescription

Gabapentin Pharm: neurontin 600 mg cost – neurontin 100 mg

neurontin: neurontin capsule 400 mg – neurontin generic south africa

http://semaglutidepharm.com/# rybelsus price

Gabapentin Pharm: neurontin price south africa – 300 mg neurontin

Ivermectin Pharm: ivermectin 2ml – Ivermectin Pharm Store

https://paxlovid.ink/# Paxlovid.ink

semaglutide pharm: rybelsus – Buy semaglutide pills

https://cytotec.top/# Abortion pills online

п»їcytotec pills online: Misoprostol 200 mg buy online – buy cytotec over the counter

cipro 500mg best prices buy cipro online without prescription cipro 500mg best prices

https://lisinoprilus.com/# lisinopril india price

zestril 20 mg: 40 mg lisinopril – order lisinopril online united states

where to get zithromax over the counter: buy zithromax 500mg online – where can i buy zithromax uk

http://ciprofloxacin.cheap/# buy ciprofloxacin over the counter

can you buy clomid for sale can i order generic clomid without dr prescription where to get generic clomid without dr prescription

zithromax without prescription: zithromax 250 price – can i buy zithromax over the counter

Cytotec 200mcg price: cytotec buy online usa – buy cytotec online fast delivery

https://clomid.store/# where to buy cheap clomid pill

cost of clomid no prescription: can you buy clomid without prescription – get generic clomid tablets

buying generic clomid prices where to get generic clomid online can you get generic clomid without insurance

http://lisinoprilus.com/# lisinopril 20 mg canadian

https://lisinoprilus.com/# zestril 25 mg

buy lisinopril canada buy lisinopril can you order lisinopril online

https://ciprofloxacin.cheap/# ciprofloxacin order online

buy cheap generic zithromax: order zithromax over the counter – how to get zithromax over the counter

where to buy cipro online: ciprofloxacin 500mg buy online – buy ciprofloxacin

https://lisinoprilus.com/# lisinopril medication

buy cytotec in usa: buy cytotec online – buy cytotec over the counter

buy cytotec online fast delivery cytotec pills buy online purchase cytotec

generic zestoretic: lisinopril 2.5 mg tablet – cost for generic lisinopril

how much is lisinopril 20 mg: lisinopril tab 100mg – zestril 5mg price in india

https://clomid.store/# can you get generic clomid without insurance

zithromax 500mg price: zithromax 250 mg tablet price – where can i buy zithromax capsules

purchase cytotec: buy cytotec over the counter – order cytotec online

http://lisinoprilus.com/# lisinopril brand

where to buy clomid without insurance can you get cheap clomid prices cost clomid without rx

lisinopril 40 mg pill: lisinopril 20 mg best price – best lisinopril brand

ciprofloxacin 500 mg tablet price: where to buy cipro online – antibiotics cipro

https://cytotec.top/# п»їcytotec pills online

buy cheap lisinopril 40 mg no prescription: how to order lisinopril online – medicine lisinopril 10 mg

cytotec buy online usa Misoprostol 200 mg buy online п»їcytotec pills online

buy lisinopril canada: lisinopril medicine – lisinopril 3

lisinopril 40 mg coupon: lisinopril 20 mg price in india – lisinopril 2.5 cost

http://lisinoprilus.com/# lisinopril 40 mg tablet

zithromax 250 zithromax for sale usa zithromax online

zithromax for sale usa: zithromax 250 mg tablet price – zithromax 250

https://clomid.store/# how to get cheap clomid prices

lisinopril tabs 20mg lisinopril 20 mg tablet zestoretic 20

zestril 5mg price in india: zestoretic 25 – zestril discount

https://lisinoprilus.com/# lisinopril online uk

https://cenforce.icu/# Cenforce 150 mg online

https://edpills.men/# best online ed treatment

semaglutide tablets: semaglutide tablets store – semaglutide best price

erectile dysfunction medication online: where can i buy erectile dysfunction pills – top rated ed pills

https://kamagra.men/# sildenafil oral jelly 100mg kamagra

http://drugs1st.pro/# ed for men

http://drugs1st.pro/# drugs1st

semaglutide best price: cheap semaglutide pills – rybelsus semaglutide tablets

drugs1st best erection pills generic ed pills

semaglutide tablets store: semaglutide best price – semaglutide tablets store

https://edpills.men/# cheapest online ed meds

http://edpills.men/# erection pills online

drugs1st: drugs1st – buy prescription drugs from canada cheap

http://drugs1st.pro/# best ed treatment

https://kamagra.men/# buy kamagra online usa

drugs1st: cure ed – how can i order prescription drugs without a doctor

https://edpills.men/# ed medicines

cenforce for sale: Buy Cenforce 100mg Online – cenforce.icu

https://edpills.men/# buy erectile dysfunction pills online

https://edpills.men/# cheapest ed medication

drugs1st: best ed medication – drugs1st

drugs1st: drugs1st – pain medications without a prescription

http://cenforce.icu/# order cenforce

http://semaglutidetablets.store/# generic rybelsus tabs

deneme bonusu veren bahis siteleri 2025 oyun s yabancД± mekan isimleri

https://casinositeleri2025.pro/# gГјvenilir siteler

en cok kazand?ran slot oyunlar?: slot oyunlar? puf noktalar? – en cok kazand?ran slot oyunlar?

pinup 2025: pinup 2025 – пин ап казино

https://pinup2025.com/# pinup2025.com

slot siteleri: az parayla cok kazandiran slot oyunlar? – slot tr online

http://casinositeleri2025.pro/# grand pasha bet

glГјcksspiel internet: vaycasino – hangi bahis siteleri bonus veriyor?

пин ап зеркало пинап казино пин ап вход

en kazancl? slot oyunlar?: az parayla cok kazandiran slot oyunlar? – slot oyunlar?

https://slottr.top/# slot siteleri

http://casinositeleri2025.pro/# deneme bonus siteler

pinup 2025 пин ап казино пин ап вход

https://pinup2025.com/# pinup 2025

http://casinositeleri2025.pro/# bedbo

en cok kazand?ran slot oyunlar? en kazancl? slot oyunlar? az parayla cok kazandiran slot oyunlar?

gazino isimleri: en iyi canlД± casino siteleri – kumar oyunlarД±

http://casinositeleri2025.pro/# deneme bonus siteler

https://slottr.top/# slot siteleri

pinup 2025 pinup2025.com пин ап казино официальный сайт

en kazancl? slot oyunlar?: slot tr online – en cok kazand?ran slot oyunlar?

https://slottr.top/# az parayla cok kazandiran slot oyunlar?

en cok kazand?ran slot oyunlar?: en cok kazand?ran slot oyunlar? – slot oyunlar?

en kazancl? slot oyunlar? slot siteleri slot oyunlar? puf noktalar?

https://slottr.top/# slot tr online

http://casinositeleri2025.pro/# kayД±t bonusu veren casino siteleri

yabancД± mekan isimleri: gГјvenilir bahis siteleri 2024 – bahis siteleei

gГјvenilir casino bahis siteleri: casino siteleri 2024 – bet siteleri bonus

pinup2025.com пин ап пин ап вход

https://casinositeleri2025.pro/# bahis oyunlarД±

yatД±rД±m bonusu veren siteler: gГјvenilir casino – vidobet giriЕџ

http://casinositeleri2025.pro/# curacao lisans siteleri

tГјrkiye nin en iyi yasal bahis sitesi pronet giriЕџ canlД± +18

https://slottr.top/# az parayla cok kazandiran slot oyunlar?

casino: casino bonusu veren siteler – en yeni deneme bonusu veren siteler 2025

slot oyunlar? puf noktalar?: en cok kazand?ran slot oyunlar? – en kazancl? slot oyunlar?

http://casinositeleri2025.pro/# bet siteleri bonus

pinup 2025 pinup2025.com pinup 2025

https://casinositeleri2025.pro/# popГјler bahis

Гјcretsiz deneme bonusu veren bahis siteleri: yeni bahis siteleri deneme bonusu – mobil bahis siteleri

siteler bahis: casino bonusu veren siteler – jackpot play nedir

100tl hosgeldin bonusu veren siteler gerçek paralı casino oyunları 1xbet bonus çevrim şartları

http://casinositeleri2025.pro/# kumar oynama siteleri

пин ап казино официальный сайт: pinup 2025 – пин ап вход

http://casinositeleri2025.pro/# casimo

пин ап зеркало пин ап зеркало пин ап казино

yasal oyun siteleri: gГјvenilir bahis siteleri – eski oyunlarД± oynama sitesi

https://slottr.top/# slot siteleri

oyun inceleme siteleri: en iyi kumar siteleri – jackpot play nedir

pharmacy website india India pharmacy international reputable indian pharmacies

http://mexicanpharmi.com/# mexico drug stores pharmacies

buying prescription drugs in mexico online: Best online Mexican pharmacy – mexico pharmacies prescription drugs

ed treatment options: Canada Pharmacy online reviews – male dysfunction pills

http://canadianpharmi.com/# buy generic ed pills online

top online pharmacy india Best online Indian pharmacy world pharmacy india

buying prescription drugs in mexico: Legit online Mexican pharmacy – medicine in mexico pharmacies

https://canadianpharmi.com/# ed help

ed in men: Cheapest drug prices Canada – medications list

mexican rx online Legit online Mexican pharmacy mexico pharmacies prescription drugs

https://mexicanpharmi.com/# buying prescription drugs in mexico online

https://mexicanpharmi.com/# medication from mexico pharmacy

https://indiapharmi.com/# cheapest online pharmacy india

erection pills that work: Cheapest drug prices Canada – top erection pills

india online pharmacy Pharmacies in India that ship to USA mail order pharmacy india

the canadian drugstore: Canada Pharmacy – cheap medication online

https://canadianpharmi.com/# drugs prices

https://canadianpharmi.com/# how can i order prescription drugs without a doctor

ed help: canadianpharmi – top rated ed pills

ed men canadianpharmi cure ed

https://mexicanpharmi.com/# medication from mexico pharmacy

http://canadianpharmi.com/# best ed treatments

http://mexicanpharmi.com/# mexico drug stores pharmacies

п»їlegitimate online pharmacies india: Indian pharmacy international shipping – п»їlegitimate online pharmacies india

mexico drug stores pharmacies: Online Mexican pharmacy – medicine in mexico pharmacies

cure ed Canadian pharmacy prices ed meds online

https://mexicanpharmi.com/# mexico drug stores pharmacies

https://canadianpharmi.com/# buy anti biotics without prescription

online pharmacy india: Best online Indian pharmacy – indian pharmacy

mexico drug stores pharmacies Online Mexican pharmacy buying from online mexican pharmacy

https://mexicanpharmi.com/# buying from online mexican pharmacy

prescription drugs canada buy online: Canada Pharmacy online reviews – ed treatment natural

http://canadianpharmi.com/# pills for ed

amoxicillin generic AmoxStar generic for amoxicillin

https://prednibest.com/# buy prednisone from canada

cheap clomid price: clomidonpharm – how to buy generic clomid without rx

buy generic ciprofloxacin: buy cipro no rx – ciprofloxacin 500mg buy online

http://amoxstar.com/# can you buy amoxicillin over the counter in canada

https://cipharmdelivery.com/# cipro online no prescription in the usa

prednisone medication can i buy prednisone from canada without a script prednisone daily

http://amoxstar.com/# amoxicillin 500mg no prescription

buy amoxicillin over the counter uk: generic amoxil 500 mg – buying amoxicillin online

cipro online no prescription in the usa cipro online no prescription in the usa ciprofloxacin mail online

http://clomidonpharm.com/# where to buy generic clomid no prescription

where to buy clomid without a prescription cost of generic clomid pill buy clomid tablets

https://cipharmdelivery.com/# ciprofloxacin

prednisone brand name: prednisone price south africa – buy prednisone online india

prednisone best prices: Predni Best – 1 mg prednisone cost

https://cipharmdelivery.com/# cipro for sale

cipro pharmacy buy ciprofloxacin over the counter buy cipro online canada

http://cipharmdelivery.com/# cipro ciprofloxacin

clomid generic: where to buy clomid without a prescription – can you get generic clomid without insurance

buy cipro online without prescription buy cipro buy cipro online

https://clomidonpharm.com/# cost of clomid

buy cipro online canada: CiPharmDelivery – buy cipro cheap

buying prednisone 40 mg daily prednisone prednisone capsules

amoxicillin without a doctors prescription: amoxicillin 500 mg price – generic amoxicillin

https://prednibest.com/# prednisone 40 mg tablet

where to get generic clomid without dr prescription: buying generic clomid without dr prescription – can you get cheap clomid without prescription

amoxicillin price without insurance amoxicillin 500mg amoxicillin 500mg capsules price

prednisone 20mg nz: Predni Best – prednisone 5mg cost

where to get clomid now: cost of clomid – where to get generic clomid price

amoxicillin price canada: amoxicillin cost australia – amoxicillin 500mg

amoxicillin 250 mg capsule Amox Star amoxicillin online canada

buy prednisone online without a script: PredniBest – buy prednisone canada

https://clomidonpharm.com/# where can i buy generic clomid pill

prednisone best price: Predni Best – prednisone 10 tablet

buy amoxicillin online with paypal Amox Star amoxicillin 500mg over the counter

https://amoxstar.com/# order amoxicillin no prescription

can i get clomid online: clomid on pharm – can i order cheap clomid for sale

50 mg prednisone canada pharmacy: buy prednisone without prescription paypal – prednisone 5 mg brand name

can i purchase clomid without insurance can i get generic clomid without prescription can you get generic clomid prices

https://prednibest.com/# prednisone 10mg price in india

where to get clomid: can i purchase generic clomid prices – clomid order

amoxicillin cephalexin AmoxStar amoxicillin online pharmacy

prednisone for dogs: 20 mg prednisone tablet – buy prednisone 10mg

http://amoxstar.com/# amoxicillin pills 500 mg

cipro online no prescription in the usa buy cipro online usa ciprofloxacin 500 mg tablet price

prednisone no rx: Predni Best – purchase prednisone from india

http://amoxstar.com/# buying amoxicillin in mexico

prednisone 50 mg coupon: 25 mg prednisone – pharmacy cost of prednisone

https://gramster.ru/# gramster.ru

http://gramster.ru/# пин ап казино официальный сайт

gramster.ru Gramster пин ап

https://gramster.ru/# пин ап зеркало

http://gramster.ru/# gramster.ru

пин ап казино официальный сайт: gramster.ru – pinup 2025

http://gramster.ru/# pinup 2025

https://gramster.ru/# пин ап вход

https://gramster.ru/# пин ап вход

https://gramster.ru/# gramster.ru

пин ап казино зеркало: Gramster – пин ап зеркало

https://gramster.ru/# пинап казино

пин ап казино официальный сайт Gramster pinup 2025

http://gramster.ru/# пин ап казино

http://gramster.ru/# пин ап зеркало

пин ап казино зеркало gramster пин ап вход

пин ап казино: gramster – gramster.ru

https://gramster.ru/# пин ап казино официальный сайт

https://gramster.ru/# пин ап казино

http://gramster.ru/# пин ап казино зеркало

https://gramster.ru/# pinup 2025

pinup 2025: gramster.ru – пин ап вход

пин ап казино gramster.ru пин ап

https://gramster.ru/# пин ап казино официальный сайт

пинап казино: Gramster – gramster.ru

https://gramster.ru/# пин ап зеркало

http://gramster.ru/# пин ап казино

пинап казино gramster.ru pinup 2025

http://gramster.ru/# пин ап казино зеркало

http://gramster.ru/# пин ап зеркало

https://gramster.ru/# пинап казино

https://gramster.ru/# gramster.ru

пин ап: gramster.ru – пин ап казино зеркало

https://gramster.ru/# пин ап казино зеркало

http://gramster.ru/# pinup 2025

http://gramster.ru/# пин ап зеркало

canadian pharmacy scam canadian pharmacy win thecanadianpharmacy

http://indianpharmacy.win/# reputable indian pharmacies

http://indianpharmacy.win/# online shopping pharmacy india

https://mexicanpharmacy.store/# mexican border pharmacies shipping to usa

reputable canadian online pharmacies: canadian pharmacy win – pharmacies in canada that ship to the us

https://mexicanpharmacy.store/# mexican mail order pharmacies

https://canadianpharmacy.win/# reliable canadian online pharmacy

https://canadianpharmacy.win/# safe canadian pharmacy

online canadian pharmacy best canadian online pharmacy vipps approved canadian online pharmacy

indianpharmacy com: Online medicine order – india pharmacy mail order

http://indianpharmacy.win/# india online pharmacy

https://mexicanpharmacy.store/# buying from online mexican pharmacy

https://indianpharmacy.win/# Online medicine order

indianpharmacy com: online shopping pharmacy india – п»їlegitimate online pharmacies india

indian pharmacies safe indian pharmacies safe india pharmacy mail order

http://canadianpharmacy.win/# canadianpharmacyworld com

http://indianpharmacy.win/# world pharmacy india

http://indianpharmacy.win/# Online medicine order

http://canadianpharmacy.win/# online canadian drugstore

india pharmacy: top 10 pharmacies in india – best india pharmacy

https://indianpharmacy.win/# mail order pharmacy india

indian pharmacy online pharmacy india indian pharmacy

https://canadianpharmacy.win/# best canadian online pharmacy reviews

https://canadianpharmacy.win/# online canadian pharmacy

online pharmacy india: cheapest online pharmacy india – india pharmacy mail order

http://indianpharmacy.win/# reputable indian online pharmacy

https://canadianpharmacy.win/# legitimate canadian mail order pharmacy

https://mexicanpharmacy.store/# mexican rx online

https://mexicanpharmacy.store/# mexican mail order pharmacies

canada pharmacy reviews canadian pharmacy win safe canadian pharmacy

precription drugs from canada: best canadian online pharmacy – reputable canadian pharmacy

http://canadianpharmacy.win/# canadian pharmacy meds reviews

https://indianpharmacy.win/# india pharmacy mail order

https://canadianpharmacy.win/# canadian 24 hour pharmacy

mexican rx online: buying prescription drugs in mexico – mexican rx online

http://mexicanpharmacy.store/# mexican mail order pharmacies

https://canadianpharmacy.win/# canadianpharmacyworld

indianpharmacy com reputable indian online pharmacy india online pharmacy

https://indianpharmacy.win/# online pharmacy india

https://indianpharmacy.win/# best india pharmacy

buying from online mexican pharmacy: п»їbest mexican online pharmacies – medication from mexico pharmacy

http://canadianpharmacy.win/# canada cloud pharmacy

http://canadianpharmacy.win/# canadian pharmacy checker

mexico pharmacies prescription drugs mexican rx online medicine in mexico pharmacies

http://canadianpharmacy.win/# best canadian pharmacy online

buying prescription drugs in mexico: mexican mail order pharmacies – buying prescription drugs in mexico

https://indianpharmacy.win/# top online pharmacy india

https://mexicanpharmacy.store/# medication from mexico pharmacy

https://canadianpharmacy.win/# canadian pharmacy ltd

buying from online mexican pharmacy: mexican online pharmacies prescription drugs – п»їbest mexican online pharmacies

http://mexicanpharmacy.store/# mexican border pharmacies shipping to usa

https://canadianpharmacy.win/# canadian mail order pharmacy

https://indianpharmacy.win/# mail order pharmacy india

http://mexicanpharmacy.store/# mexico drug stores pharmacies

canadian pharmacy checker: best canadian online pharmacy – canadian pharmacy meds review

http://canadianpharmacy.win/# best canadian pharmacy

http://indianpharmacy.win/# indian pharmacy online

http://canadianpharmacy.win/# reddit canadian pharmacy

mexican pharmaceuticals online mexican pharmaceuticals online buying prescription drugs in mexico online

online erectile dysfunction medication get ed meds today ed pills cheap

buy viagra here: cheap viagra – Buy Viagra online cheap

https://fastpillsformen.com/# Generic Viagra online

Tadalafil price: Max Pills For Men – Cialis 20mg price in USA

http://fastpillsformen.com/# Sildenafil Citrate Tablets 100mg

Generic Cialis price buy cialis online cheapest cialis

https://maxpillsformen.com/# Generic Tadalafil 20mg price

Cialis without a doctor prescription: Max Pills For Men – п»їcialis generic

http://fastpillsformen.com/# sildenafil over the counter

Generic Cialis without a doctor prescription: Generic Cialis without a doctor prescription – Cialis 20mg price in USA

Generic Cialis price MaxPillsForMen Cialis 20mg price

Tadalafil price: MaxPillsForMen – п»їcialis generic

https://fastpillseasy.com/# erectile dysfunction medication online

https://fastpillseasy.com/# erectile dysfunction medication online

cheapest viagra FastPillsForMen buy viagra here

erectile dysfunction pills online: fast pills easy – buy ed pills

Buy Cialis online: MaxPillsForMen – Cialis 20mg price in USA

http://fastpillseasy.com/# erectile dysfunction medications online

Generic Tadalafil 20mg price buy cialis online Tadalafil Tablet

http://fastpillsformen.com/# Viagra online price

erectile dysfunction medications online: FastPillsEasy – get ed prescription online

http://fastpillseasy.com/# ed online pharmacy

ed meds cheap: FastPillsEasy – order ed meds online

cheapest cialis Max Pills For Men Generic Cialis without a doctor prescription

https://maxpillsformen.com/# Generic Cialis price

http://fastpillseasy.com/# where can i buy ed pills

buy Viagra over the counter: FastPillsForMen.com – Cheap generic Viagra

ed meds cheap cheap ed best online ed meds

http://maxpillsformen.com/# cialis for sale

buy cialis pill: Cialis over the counter – Buy Tadalafil 5mg

Cialis over the counter: MaxPillsForMen.com – Generic Cialis price

https://fastpillsformen.com/# Order Viagra 50 mg online

best ed meds online fast pills easy where can i buy ed pills

http://fastpillsformen.com/# Cheap Viagra 100mg

Cheap Viagra 100mg: Viagra without a doctor prescription Canada – sildenafil over the counter

Generic Cialis without a doctor prescription: MaxPillsForMen – Tadalafil price

online prescription for ed FastPillsEasy buy ed pills online

https://fastpillsformen.com/# Viagra Tablet price

https://fastpillsformen.com/# sildenafil online

viagra without prescription: cheap viagra – Cheap Viagra 100mg

https://maxpillsformen.com/# Cialis 20mg price

ed pills for sale FastPillsEasy low cost ed meds

http://fastpillseasy.com/# where to buy ed pills

cheapest viagra: cheap viagra – viagra canada

http://maxpillsformen.com/# Buy Tadalafil 5mg

low cost ed medication: FastPillsEasy – what is the cheapest ed medication

https://maxpillsformen.com/# Buy Tadalafil 20mg

Buy Tadalafil 10mg buy cialis online Tadalafil price

https://maxpillsformen.com/# Buy Tadalafil 20mg

Tadalafil price: buy cialis online – Cialis 20mg price in USA

buy Viagra over the counter cheap viagra sildenafil 50 mg price

https://fastpillsformen.com/# Viagra without a doctor prescription Canada

cheapest cialis: Generic Cialis without a doctor prescription – Cialis 20mg price in USA

Tadalafil price MaxPillsForMen cheapest cialis

cheapest ed meds: cheap cialis – cheap ed meds

https://maxpillsformen.com/# Generic Tadalafil 20mg price

boner pills online: fast pills easy – ed prescription online

Viagra Tablet price buy viagra online Viagra without a doctor prescription Canada

http://fastpillseasy.com/# where can i buy ed pills

Buy Tadalafil 10mg: Tadalafil Tablet – Buy Tadalafil 20mg

ed online treatment FastPillsEasy cheap ed drugs

Casino Siteleri: Casino Siteleri – deneme bonusu veren casino siteleri

https://slotsiteleri25.com/# slot casino siteleri

https://sweetbonanza25.com/# sweet bonanza kazanma saatleri

en cok kazand?ran slot oyunlar?: en kazancl? slot oyunlar? – slot oyunlar? puf noktalar?

http://sweetbonanza25.com/# sweet bonanza slot

http://denemebonusuverensiteler25.com/# deneme bonusu veren yeni siteler

deneme bonusu veren siteler yeni: deneme bonusu veren siteler – yat?r?ms?z deneme bonusu veren siteler

http://sweetbonanza25.com/# sweet bonanza guncel

slot oyunlar? puf noktalar?: az parayla cok kazandiran slot oyunlar? – en kazancl? slot oyunlar?

yeni deneme bonusu veren siteler yat?r?ms?z deneme bonusu veren siteler deneme bonusu veren siteler

deneme bonusu veren yeni siteler deneme bonusu veren siteler deneme bonusu veren siteler yeni

guvenilir casino siteleri: casino bahis siteleri – canl? casino siteleri

https://slotsiteleri25.com/# az parayla cok kazandiran slot oyunlar?

sweet bonanza guncel sweet bonanza slot sweet bonanza oyna

yat?r?ms?z deneme bonusu veren siteler: deneme bonusu veren yeni siteler – denemebonusuverensiteler25

https://sweetbonanza25.com/# sweet bonanza giris

sweet bonanza kazanma saatleri: sweet bonanza guncel – sweet bonanza demo oyna

en kazancl? slot oyunlar? en cok kazand?ran slot oyunlar? en cok kazand?ran slot oyunlar?

canl? casino siteleri: Canl? Casino Siteleri – levante casino

http://denemebonusuverensiteler25.com/# yeni deneme bonusu veren siteler

yat?r?ms?z deneme bonusu veren siteler deneme bonusu veren siteler deneme bonusu veren yeni siteler

deneme bonusu veren casino siteleri: casino bahis siteleri – en guvenilir casino siteleri

deneme bonusu veren siteler: denemebonusuverensiteler25 – deneme bonusu veren yeni siteler

en cok kazand?ran slot oyunlar? az parayla cok kazandiran slot oyunlar? guvenilir slot siteleri

slot casino siteleri: en kazancl? slot oyunlar? – slot oyunlar?

en Г§ok kazandД±ran bahis siteleri

https://casinositeleri25.com/# casino bahis siteleri

yat?r?ms?z deneme bonusu veren siteler: deneme bonusu veren yeni siteler – deneme bonusu veren yeni siteler

casino bahis siteleri: deneme bonusu veren casino siteleri – en guvenilir casino siteleri

az parayla cok kazandiran slot oyunlar? slot oyunlar? slot casino siteleri

sweet bonanza demo oyna: sweet bonanza slot – sweet bonanza oyna

sweet bonanza slot sweet bonanza kazanma saatleri sweet bonanza oyna

deneme bonusu veren yeni siteler: deneme bonusu veren yeni siteler – yat?r?ms?z deneme bonusu veren siteler

https://casinositeleri25.com/# Deneme Bonusu Veren Siteler

en cok kazand?ran slot oyunlar? en cok kazand?ran slot oyunlar? az parayla cok kazandiran slot oyunlar?

Casino Siteleri: deneme bonusu veren casino siteleri – Casino Siteleri

denemebonusuverensiteler25: denemebonusuverensiteler25 – yeni deneme bonusu veren siteler

slot casino siteleri slot oyunlar? puf noktalar? slot oyunlar? puf noktalar?

https://casinositeleri25.com/# guvenilir casino siteleri

en cok kazand?ran slot oyunlar?: slot siteleri – az parayla cok kazandiran slot oyunlar?

yat?r?ms?z deneme bonusu veren siteler: deneme bonusu veren yeni siteler – yeni deneme bonusu veren siteler

sweet bonanza sweet bonanza slot sweet bonanza yorumlar

slot oyunlar? puf noktalar?: en cok kazand?ran slot oyunlar? – az parayla cok kazandiran slot oyunlar?

https://slotsiteleri25.com/# en cok kazand?ran slot oyunlar?

deneme bonusu veren siteler yat?r?ms?z deneme bonusu veren siteler deneme bonusu veren siteler

https://indiancertpharm.com/# Indian Cert Pharm

canadian pharmacy price checker

Best online Indian pharmacy: Indian Cert Pharm – Indian pharmacy that ships to usa

canadian discount pharmacy https://canadianmdpharm.com/# online canadian pharmacy

п»їlegitimate online pharmacies india

Indian pharmacy international shipping indian pharmacies safe Online pharmacy

https://indiancertpharm.shop/# Best online Indian pharmacy

canadian pharmacy king reviews

legit canadian online pharmacy https://canadianmdpharm.online/# canadian pharmacy price checker

indian pharmacy paypal

canadian pharmacy phone number: Canadian Md Pharm – canadian discount pharmacy

canadian pharmacy price checker https://canadianmdpharm.com/# canadian online drugstore

reputable indian online pharmacy

Online medicine: Indian Cert Pharm – indianpharmacy com

Mexican Easy Pharm: mexican pharmaceuticals online – mexican mail order pharmacies

best canadian online pharmacy reviews https://indiancertpharm.shop/# buy medicines online in india

indianpharmacy com

certified canadian international pharmacy https://indiancertpharm.shop/# Indian Cert Pharm

indianpharmacy com

mexican drugstore online: Mexican Easy Pharm – medicine in mexico pharmacies

https://indiancertpharm.com/# Indian Cert Pharm

canadian pharmacy 365

canadian pharmacies compare: canada drugs – canadian pharmacy no scripts

canadian pharmacy service Canadian Md Pharm canadian pharmacy world

canadian world pharmacy https://canadianmdpharm.com/# prescription drugs canada buy online

Online medicine home delivery

Mexican Easy Pharm: Mexican Easy Pharm – Mexican Easy Pharm

best online pharmacies in mexico: Mexican Easy Pharm – Mexican Easy Pharm

canadian neighbor pharmacy https://indiancertpharm.com/# IndianCertPharm

indian pharmacies safe

thecanadianpharmacy legitimate canadian pharmacies safe canadian pharmacies

Mexican Easy Pharm: mexico drug stores pharmacies – Mexican Easy Pharm

mexican mail order pharmacies: Mexican Easy Pharm – Mexican Easy Pharm

canadianpharmacyworld https://canadianmdpharm.com/# reputable canadian online pharmacies

india online pharmacy

Mexican Easy Pharm Mexican Easy Pharm Mexican Easy Pharm

mexican border pharmacies shipping to usa: Mexican Easy Pharm – Mexican Easy Pharm

canadian pharmacy: buy prescription drugs from canada cheap – buy drugs from canada

canada cloud pharmacy https://indiancertpharm.com/# Indian Cert Pharm

reputable indian online pharmacy

Indian Cert Pharm: online pharmacy india – Online pharmacy

canadian drugs pharmacy best canadian pharmacy to buy from canadian pharmacies comparison

Mexican Easy Pharm: Mexican Easy Pharm – Mexican Easy Pharm

india pharmacy: Best online Indian pharmacy – Indian Cert Pharm

https://canadianmdpharm.com/# reputable canadian pharmacy

reliable canadian online pharmacy

reliable canadian pharmacy: Canadian Md Pharm – canadian pharmacy 24

Indian pharmacy international shipping: indian pharmacy – cheapest online pharmacy india

canada pharmacy 24h: CanadianMdPharm – canadian pharmacy com

Mexican Easy Pharm: mexican mail order pharmacies – Mexican Easy Pharm

IndianCertPharm: Indian pharmacy international shipping – IndianCertPharm

canadian pharmacy antibiotics https://indiancertpharm.com/# Online medicine

indianpharmacy com

mexico drug stores pharmacies: Mexican Easy Pharm – purple pharmacy mexico price list

reputable canadian online pharmacies: canada drug pharmacy – canadianpharmacy com

buying prescription drugs in mexico online: Mexican Easy Pharm – pharmacies in mexico that ship to usa

Mexican Easy Pharm: mexican online pharmacies prescription drugs – Mexican Easy Pharm

Best Indian pharmacy: online pharmacy india – indian pharmacy

indian pharmacy: Indian pharmacy international shipping – Indian Cert Pharm

canadian world pharmacy: cheapest pharmacy canada – best canadian pharmacy to order from

legal canadian pharmacy online: Canadian Md Pharm – best rated canadian pharmacy

https://mexicaneasypharm.shop/# п»їbest mexican online pharmacies

canada pharmacy 24h

Indian Cert Pharm: reputable indian pharmacies – Online pharmacy

canada pharmacy online: canadianpharmacyworld – onlinecanadianpharmacy 24

canadian pharmacy ratings: canadian online pharmacy reviews – medication canadian pharmacy

canadian pharmacy uk delivery: Canadian Md Pharm – canada drugs online review

Mexican Easy Pharm Mexican Easy Pharm mexican pharmaceuticals online

canada pharmacy online: canadian pharmacy – pharmacies in canada that ship to the us

pharmacies in mexico that ship to usa https://mexicaneasypharm.shop/# Mexican Easy Pharm

buying prescription drugs in mexico

canadian pharmacy mall: CanadianMdPharm – canada drugs online reviews

IndianCertPharm: india pharmacy – IndianCertPharm

purple pharmacy mexico price list https://mexicaneasypharm.com/# Mexican Easy Pharm

mexican mail order pharmacies

Indian Cert Pharm online shopping pharmacy india IndianCertPharm

mexican drugstore online: Mexican Easy Pharm – Mexican Easy Pharm

https://canadianmdpharm.com/# escrow pharmacy canada

certified canadian pharmacy

best online pharmacies in mexico https://mexicaneasypharm.com/# Mexican Easy Pharm

mexican rx online

Indian Cert Pharm indian pharmacy Indian pharmacy international shipping

http://dappharm.com/# cheap priligy

Kamagra 100mg price

http://kamapharm.com/# Kama Pharm

generic prednisone pills

http://kamapharm.com/# Kama Pharm

sildenafil oral jelly 100mg kamagra

Priligy tablets dapoxetine price buy priligy

http://kamapharm.com/# super kamagra

prednisone 10

semaglutide tablets: semaglutide tablets for weight loss – generic rybelsus tabs

CytPharm: buy cytotec pills online cheap – cytotec online

https://cytpharm.shop/# buy cytotec

п»їkamagra

Kama Pharm: Kama Pharm – Kama Pharm

https://dappharm.shop/# DapPharm

prednisone 0.5 mg

order cytotec online buy cytotec buy cytotec online

https://semapharm24.com/# rybelsus semaglutide tablets

Kamagra 100mg price

buy Kamagra: Kamagra tablets – п»їkamagra

Kama Pharm: cheap kamagra – Kama Pharm

http://predpharm.com/# buy generic prednisone online

cheap generic prednisone

http://kamapharm.com/# Kama Pharm

Kamagra 100mg

Kama Pharm buy Kamagra Kama Pharm

Abortion pills online: cytotec abortion pill – cytotec abortion pill

PredPharm: prednisone pills cost – PredPharm

http://dappharm.com/# priligy

sildenafil oral jelly 100mg kamagra

https://semapharm24.com/# SemaPharm24

prednisone 10mg cost

cheap priligy dap pharm dap pharm

prednisone 20mg online: prednisone online australia – generic prednisone online

https://semapharm24.shop/# generic rybelsus tabs

Kamagra 100mg price

PredPharm: PredPharm – Pred Pharm

Priligy tablets: dapoxetine online – cheap priligy

https://cytpharm.shop/# CytPharm

Kamagra tablets

https://cytpharm.com/# buy cytotec online

prednisone generic brand name

Kama Pharm: п»їkamagra – п»їkamagra

semaglutide tablets store: semaglutide tablets – semaglutide tablets

https://predpharm.shop/# buy prednisone 20mg without a prescription best price

Kamagra 100mg

Abortion pills online: CytPharm – buy cytotec in usa

dapoxetine price cheap priligy buy dapoxetine online

https://cytpharm.com/# buy cytotec pills online cheap

steroids prednisone for sale

buy cytotec in usa: buy cytotec over the counter – Cyt Pharm

https://semapharm24.com/# Sema Pharm 24

Kamagra 100mg price

generic rybelsus tabs: cheap semaglutide pills – semaglutide best price

https://kamapharm.com/# п»їkamagra

Kamagra Oral Jelly

Kama Pharm: Kama Pharm – Kama Pharm

Kama Pharm: buy Kamagra – Kama Pharm

https://dappharm.com/# DapPharm

prednisone 5mg capsules

PredPharm Pred Pharm PredPharm

Kama Pharm: Kama Pharm – Kama Pharm

super kamagra: Kamagra Oral Jelly – buy Kamagra

http://predpharm.com/# PredPharm

Kamagra 100mg price

Pred Pharm: PredPharm – Pred Pharm

https://predpharm.com/# Pred Pharm

buy prednisone with paypal canada

п»їcytotec pills online: Cyt Pharm – Cyt Pharm

prednisone 20 mg purchase prednisone without rx 25 mg prednisone

buy cytotec online: Cyt Pharm – Cytotec 200mcg price

Kama Pharm: super kamagra – cheap kamagra

https://dappharm.shop/# Priligy tablets

order prednisone

http://cytpharm.com/# Cyt Pharm

cheap kamagra

Pred Pharm: Pred Pharm – can you buy prednisone over the counter in mexico

Kama Pharm: Kama Pharm – Kama Pharm

semaglutide tablets generic rybelsus tabs semaglutide tablets for weight loss

https://dappharm.shop/# buy dapoxetine online

Kamagra 100mg

https://cytpharm.shop/# п»їcytotec pills online

prednisone 20 mg tablets coupon

Kamagra tablets: Kama Pharm – Kama Pharm

cheap semaglutide pills semaglutide tablets store semaglutide tablets store

prednisone 5mg price: PredPharm – prednisone 20mg tablets where to buy

https://predpharm.shop/# Pred Pharm

by prednisone w not prescription

generic rybelsus tabs: buy rybelsus online – SemaPharm24

Pred Pharm: PredPharm – prednisone pill 10 mg

http://semapharm24.com/# semaglutide best price

sildenafil oral jelly 100mg kamagra

buy dapoxetine online buy dapoxetine online DapPharm

https://kamapharm.shop/# Kama Pharm

prednisone 15 mg tablet

Kama Pharm: Kamagra 100mg price – sildenafil oral jelly 100mg kamagra

priligy: dapoxetine price – buy priligy

https://semapharm24.com/# SemaPharm24

prednisone sale

https://cytpharm.shop/# buy cytotec online

Kamagra tablets

prednisone 30 mg tablet: Pred Pharm – Pred Pharm

dap pharm: cheap priligy – dapoxetine price

Kama Pharm Kamagra 100mg price Kamagra tablets

Cyt Pharm: CytPharm – cytotec pills buy online

https://predpharm.shop/# PredPharm

buy prednisone mexico

https://farmabrufen.shop/# Ibuprofene 600 prezzo senza ricetta

Farmacie on line spedizione gratuita

Farmacia online piГ№ conveniente: FarmTadalItaly – farmacia online

top farmacia online

https://farmaprodotti.com/# farmacie online autorizzate elenco

farmacia online senza ricetta

Farmacie online sicure: Cialis generico prezzo – Farmacia online miglior prezzo

http://farmasilditaly.com/# miglior sito per comprare viagra online

farmacia online senza ricetta

acquistare farmaci senza ricetta: BRUFEN prezzo – farmacie online autorizzate elenco

acquisto farmaci con ricetta

farmacie online affidabili Farma Prodotti farmacia online senza ricetta

https://farmabrufen.shop/# Farma Brufen

farmaci senza ricetta elenco

viagra generico in farmacia costo: FarmaSildItaly – viagra originale in 24 ore contrassegno

Farmacia online piГ№ conveniente

http://farmabrufen.com/# BRUFEN 600 acquisto online

farmacia online piГ№ conveniente

viagra online spedizione gratuita viagra farmacia pillole per erezione in farmacia senza ricetta

https://farmaprodotti.shop/# Farmacie on line spedizione gratuita

migliori farmacie online 2024

pillole per erezione in farmacia senza ricetta: Viagra – cialis farmacia senza ricetta

top farmacia online: Cialis generico prezzo – Farmacia online miglior prezzo

top farmacia online: Ibuprofene 600 prezzo senza ricetta – Farmacia online piГ№ conveniente

farmacie online affidabili

http://farmaprodotti.com/# farmacia online senza ricetta

Farmacia online piГ№ conveniente

farmacia online senza ricetta Farma Prodotti farmacie online sicure

farmacia online: Tadalafil generico migliore – farmacie online autorizzate elenco

https://farmaprodotti.shop/# п»їFarmacia online migliore

farmaci senza ricetta elenco

https://farmasilditaly.com/# viagra online in 2 giorni

farmacia online

п»їFarmacia online migliore: Farmacie on line spedizione gratuita – comprare farmaci online all’estero

top farmacia online: Cialis generico farmacia – comprare farmaci online con ricetta

farmaci senza ricetta elenco

https://farmasilditaly.com/# cerco viagra a buon prezzo

top farmacia online

dove acquistare viagra in modo sicuro acquisto viagra viagra naturale

farmacia online senza ricetta: Tadalafil generico migliore – comprare farmaci online con ricetta

migliori farmacie online 2024

farmacie online sicure: Farm Tadal Italy – acquisto farmaci con ricetta

https://farmasilditaly.com/# miglior sito per comprare viagra online

farmaci senza ricetta elenco

farmaci senza ricetta elenco: farmacia online piГ№ conveniente – Farmacie on line spedizione gratuita

acquisto farmaci con ricetta

cialis farmacia senza ricetta: FarmaSildItaly – viagra pfizer 25mg prezzo

farmacie online autorizzate elenco: BRUFEN prezzo – comprare farmaci online con ricetta

acquisto farmaci con ricetta

farmacia online senza ricetta: FarmTadalItaly – Farmacie online sicure

alternativa al viagra senza ricetta in farmacia: Viagra – viagra ordine telefonico

Farmacie online sicure

Farmacie online sicure Farma Prodotti farmacia online piГ№ conveniente

https://farmabrufen.shop/# Ibuprofene 600 prezzo senza ricetta

farmacia online senza ricetta

viagra originale in 24 ore contrassegno: FarmaSildItaly – pillole per erezione immediata

http://farmaprodotti.com/# Farmacie on line spedizione gratuita

Farmacie on line spedizione gratuita

farmacia online piГ№ conveniente: Ibuprofene 600 prezzo senza ricetta – farmacie online autorizzate elenco

comprare farmaci online all’estero FarmaBrufen Farmacia online piГ№ conveniente

viagra prezzo farmacia 2023: Farma Sild Italy – viagra originale recensioni

https://farmatadalitaly.com/# comprare farmaci online con ricetta

farmaci senza ricetta elenco

farmacia online piГ№ conveniente: Farma Prodotti – comprare farmaci online all’estero

miglior sito dove acquistare viagra viagra senza ricetta viagra originale in 24 ore contrassegno

viagra generico recensioni: Farma Sild Italy – viagra online spedizione gratuita

farmacie online sicure

https://farmaprodotti.shop/# farmacia online piГ№ conveniente

Farmacie on line spedizione gratuita

Farmacia online miglior prezzo: Farma Prodotti – farmaci senza ricetta elenco

Farmacia online piГ№ conveniente: Farma Prodotti – Farmacie online sicure

farmacia online

acquisto farmaci con ricetta: Farma Prodotti – comprare farmaci online all’estero

farmacia online senza ricetta Farma Prodotti farmacie online sicure

п»їFarmacia online migliore: FarmaBrufen – п»їFarmacia online migliore

acquistare farmaci senza ricetta

viagra online spedizione gratuita acquisto viagra viagra generico prezzo piГ№ basso

acquistare farmaci senza ricetta https://farmaprodotti.com/# Farmacie on line spedizione gratuita

farmacie online sicure

https://phtaya.tech/# Loyalty programs reward regular customers generously.

Resorts provide both gaming and relaxation options.

La competencia entre casinos beneficia a los jugadores.: winchile – winchile

http://taya777.icu/# Some casinos have luxurious spa facilities.

The casino scene is constantly evolving.

Live music events often accompany gaming nights.: taya365 login – taya365 login

Security measures ensure a safe environment. https://jugabet.xyz/# Las estrategias son clave en los juegos.

La competencia entre casinos beneficia a los jugadores.: jugabet chile – jugabet chile

http://taya777.icu/# Entertainment shows are common in casinos.

Slot machines attract players with big jackpots.

taya777 taya777 login Players can enjoy high-stakes betting options.

La adrenalina es parte del juego.: winchile casino – winchile.pro

The casino atmosphere is thrilling and energetic. https://phtaya.tech/# Loyalty programs reward regular customers generously.

Los juegos de mesa son clГЎsicos eternos.: win chile – winchile.pro

http://taya777.icu/# п»їCasinos in the Philippines are highly popular.

Cashless gaming options are becoming popular.

Muchos casinos tienen salas de bingo.: jugabet chile – jugabet.xyz

http://jugabet.xyz/# La historia del juego en Chile es rica.

Security measures ensure a safe environment.

Entertainment shows are common in casinos. http://jugabet.xyz/# Los torneos de poker generan gran interГ©s.

Las reservas en lГnea son fГЎciles y rГЎpidas.: winchile.pro – winchile.pro

taya365 taya365 com login The ambiance is designed to excite players.

The ambiance is designed to excite players.: taya365 – taya365.art

https://winchile.pro/# Las aplicaciones mГіviles permiten jugar en cualquier lugar.

The Philippines has several world-class integrated resorts.

The casino atmosphere is thrilling and energetic. http://phmacao.life/# Casino promotions draw in new players frequently.

Casinos often host special holiday promotions.: phtaya casino – phtaya casino

Game rules can vary between casinos.: taya365 com login – taya365 login

Gambling regulations are strictly enforced in casinos. http://jugabet.xyz/# Las ganancias son una gran motivaciГіn.

taya777 app taya777 register login Live music events often accompany gaming nights.

The casino industry supports local economies significantly.: phtaya.tech – phtaya casino

https://winchile.pro/# Hay reglas especГficas para cada juego.

Many casinos host charity events and fundraisers.

La seguridad es prioridad en los casinos.: winchile – win chile

Loyalty programs reward regular customers generously. http://phmacao.life/# Promotions are advertised through social media channels.

The casino industry supports local economies significantly.: phtaya casino – phtaya

The ambiance is designed to excite players.: phtaya.tech – phtaya.tech

phmacao phmacao com login The casino experience is memorable and unique.

https://phtaya.tech/# Manila is home to many large casinos.

The Philippines has a vibrant nightlife scene.

Live music events often accompany gaming nights. https://phtaya.tech/# The thrill of winning keeps players engaged.

Casinos offer delicious dining options on-site.: phtaya casino – phtaya login

http://taya365.art/# Casino promotions draw in new players frequently.

The casino experience is memorable and unique.

The casino scene is constantly evolving.: taya777 – taya777.icu

The ambiance is designed to excite players. https://taya777.icu/# Manila is home to many large casinos.

Loyalty programs reward regular customers generously.: phmacao com – phmacao com login

http://phmacao.life/# The poker community is very active here.

Casino visits are a popular tourist attraction.

phmacao com phmacao com login Casino visits are a popular tourist attraction.

Players can enjoy high-stakes betting options.: taya777 – taya777 app

Some casinos have luxurious spa facilities.: phmacao club – phmacao casino

http://phtaya.tech/# The casino atmosphere is thrilling and energetic.

Manila is home to many large casinos.

Los casinos celebran festivales de juego anualmente.: winchile casino – win chile

http://phtaya.tech/# Live music events often accompany gaming nights.

Players often share tips and strategies.

The casino scene is constantly evolving.: phtaya casino – phtaya casino

taya777 login taya777.icu Casinos offer delicious dining options on-site.

Los croupiers son amables y profesionales.: winchile.pro – winchile.pro

https://winchile.pro/# Los casinos organizan eventos especiales regularmente.

Entertainment shows are common in casinos.

Los casinos celebran festivales de juego anualmente.: jugabet.xyz – jugabet.xyz

Visitors come from around the world to play.: taya365 com login – taya365

https://jugabet.xyz/# Es comГєn ver jugadores sociales en mesas.

The casino scene is constantly evolving.

Casinos often host special holiday promotions. http://phmacao.life/# The Philippines has a vibrant nightlife scene.

Casinos often host special holiday promotions.: taya365 login – taya365

taya365 login taya365 login The poker community is very active here.

http://winchile.pro/# Los jugadores disfrutan del pГіker en lГnea.

Game rules can vary between casinos.

Gambling regulations are strictly enforced in casinos.: phtaya login – phtaya.tech

http://taya777.icu/# Players enjoy a variety of table games.

The thrill of winning keeps players engaged.

Security measures ensure a safe environment.: taya777 register login – taya777 app

Some casinos have luxurious spa facilities.: phtaya – phtaya

http://phtaya.tech/# Loyalty programs reward regular customers generously.

The thrill of winning keeps players engaged.

taya777 app taya777 register login Most casinos offer convenient transportation options.

Los jugadores deben jugar con responsabilidad.: jugabet – jugabet

https://phtaya.tech/# Entertainment shows are common in casinos.

Loyalty programs reward regular customers generously.

La historia del juego en Chile es rica.: winchile – winchile

Players must be at least 21 years old.: taya365.art – taya365 login

http://taya365.art/# Resorts provide both gaming and relaxation options.

Casinos offer delicious dining options on-site.

winchile casino winchile casino Los jugadores disfrutan del pГіker en lГnea.

http://taya777.icu/# Promotions are advertised through social media channels.

Manila is home to many large casinos.

Players enjoy both fun and excitement in casinos.: phtaya login – phtaya login

Los casinos organizan eventos especiales regularmente.: winchile – win chile

https://taya365.art/# Slot tournaments create friendly competitions among players.

The ambiance is designed to excite players.

Some casinos have luxurious spa facilities.: phmacao casino – phmacao club

Manila is home to many large casinos.: taya365 – taya365 login

Security measures ensure a safe environment. https://taya365.art/# Live music events often accompany gaming nights.

phtaya phtaya.tech Security measures ensure a safe environment.

https://taya777.icu/# Some casinos feature themed gaming areas.

Players enjoy both fun and excitement in casinos.

Los jackpots progresivos atraen a los jugadores.: jugabet chile – jugabet

Entertainment shows are common in casinos.: taya365.art – taya365.art

http://taya365.art/# Cashless gaming options are becoming popular.

Security measures ensure a safe environment.

canada online pharmacy no prescription https://easycanadianpharm.com/# easy canadian pharm

canadian pharmacy discount code: drug mart – drugmart

promo code for canadian pharmacy meds http://familypharmacy.company/# online pharmacy delivery usa

pharmacy coupons https://megaindiapharm.com/# MegaIndiaPharm

xxl mexican pharm: xxl mexican pharm – xxl mexican pharm

online pharmacy prescription Online pharmacy USA Online pharmacy USA

MegaIndiaPharm: MegaIndiaPharm – Mega India Pharm

cheapest pharmacy to fill prescriptions without insurance http://discountdrugmart.pro/# discount drug pharmacy

xxl mexican pharm: xxl mexican pharm – medication from mexico pharmacy

Cheapest online pharmacy: online pharmacy discount code – Cheapest online pharmacy

canadian pharmacy coupon code https://megaindiapharm.com/# Mega India Pharm

best online pharmacy no prescription https://xxlmexicanpharm.com/# xxl mexican pharm

drug mart discount drugs discount drug mart pharmacy

MegaIndiaPharm: MegaIndiaPharm – buy prescription drugs from india

rx pharmacy coupons http://familypharmacy.company/# drugstore com online pharmacy prescription drugs

discount drugs: discount drug pharmacy – discount drug mart pharmacy

online pharmacy discount code http://discountdrugmart.pro/# discount drugs

easy canadian pharm: easy canadian pharm – easy canadian pharm

canadian pharmacy without prescription: discount drugs – drugmart

online pharmacy no prescription needed https://xxlmexicanpharm.com/# xxl mexican pharm

easy canadian pharm easy canadian pharm canadian pharmacy 24

india online pharmacy: MegaIndiaPharm – buy prescription drugs from india

pharmacy online 365 discount code http://easycanadianpharm.com/# canadian pharmacy 24h com safe

canada cloud pharmacy: easy canadian pharm – easy canadian pharm

cheapest pharmacy for prescriptions https://familypharmacy.company/# online pharmacy discount code

canadian pharmacy coupon http://megaindiapharm.com/# indian pharmacies safe

MegaIndiaPharm: Mega India Pharm – MegaIndiaPharm

canadian pharmacy world coupon http://discountdrugmart.pro/# drugmart

easy canadian pharm: pharmacy com canada – best canadian online pharmacy

legal online pharmacy coupon code https://familypharmacy.company/# online pharmacy delivery usa

easy canadian pharm: legitimate canadian pharmacies – easy canadian pharm

cheapest pharmacy to fill prescriptions without insurance https://familypharmacy.company/# Best online pharmacy

mail order pharmacy no prescription http://xxlmexicanpharm.com/# buying from online mexican pharmacy

discount drug mart pharmacy: drugmart – discount drug mart pharmacy

mexican drugstore online: buying prescription drugs in mexico – xxl mexican pharm

online pharmacy no prescription https://xxlmexicanpharm.com/# xxl mexican pharm

reputable mexican pharmacies online purple pharmacy mexico price list xxl mexican pharm

canadian pharmacy no prescription https://easycanadianpharm.com/# canadian pharmacy online reviews

easy canadian pharm: canadian pharmacy 365 – canadian pharmacy com

canadian pharmacy coupon https://megaindiapharm.shop/# Online medicine home delivery

Mega India Pharm: top 10 online pharmacy in india – india pharmacy

no prescription needed pharmacy https://familypharmacy.company/# Best online pharmacy

canadian pharmacy world coupon https://discountdrugmart.pro/# discount drug mart pharmacy

xxl mexican pharm: mexico drug stores pharmacies – п»їbest mexican online pharmacies

xxl mexican pharm xxl mexican pharm xxl mexican pharm

legit non prescription pharmacies https://discountdrugmart.pro/# discount drug mart pharmacy

cheapest pharmacy to fill prescriptions with insurance http://discountdrugmart.pro/# drugmart

MegaIndiaPharm: Mega India Pharm – Mega India Pharm

Online pharmacy USA: Online pharmacy USA – family pharmacy

rx pharmacy coupons https://xxlmexicanpharm.com/# xxl mexican pharm

no prescription pharmacy paypal http://familypharmacy.company/# Best online pharmacy

canadian pharmacy coupon code https://familypharmacy.company/# canadian pharmacy world coupon

xxl mexican pharm: xxl mexican pharm – xxl mexican pharm

xxl mexican pharm: mexican rx online – mexican pharmaceuticals online

drug mart drugmart discount drugs

easy canadian pharm: canada discount pharmacy – reputable canadian pharmacy

online pharmacy prescription https://familypharmacy.company/# family pharmacy

cheapest pharmacy to fill prescriptions without insurance https://easycanadianpharm.com/# easy canadian pharm

discount drug mart pharmacy: discount drug mart pharmacy – prescription drugs from canada

no prescription pharmacy paypal http://megaindiapharm.com/# MegaIndiaPharm

drugmart: drugmart – drug mart

us pharmacy no prescription https://megaindiapharm.shop/# Mega India Pharm

online pharmacy prescription http://xxlmexicanpharm.com/# xxl mexican pharm

easy canadian pharm: easy canadian pharm – canadian online drugstore

rx pharmacy no prescription http://megaindiapharm.com/# MegaIndiaPharm

best no prescription pharmacy https://discountdrugmart.pro/# drugmart

rxpharmacycoupons drug mart discount drug pharmacy

discount drug mart pharmacy: discount drug mart pharmacy – drug mart

п»їbest mexican online pharmacies: mexican mail order pharmacies – xxl mexican pharm

promo code for canadian pharmacy meds https://megaindiapharm.com/# MegaIndiaPharm

rx pharmacy coupons http://xxlmexicanpharm.com/# xxl mexican pharm

family pharmacy: Cheapest online pharmacy – family pharmacy

online pharmacy discount code http://discountdrugmart.pro/# discount drug mart

mexican pharmaceuticals online: xxl mexican pharm – xxl mexican pharm

us pharmacy no prescription http://familypharmacy.company/# family pharmacy

discount drugs discount drug pharmacy discount drug mart pharmacy

canadian pharmacy coupon https://familypharmacy.company/# Online pharmacy USA

Best online pharmacy: online pharmacy delivery usa – Best online pharmacy

canadian pharmacy no prescription https://easycanadianpharm.com/# canada pharmacy reviews

prescription drugs online http://discountdrugmart.pro/# discount drugs

xxl mexican pharm: mexican pharmaceuticals online – buying prescription drugs in mexico online

non prescription medicine pharmacy https://megaindiapharm.com/# MegaIndiaPharm

non prescription medicine pharmacy https://discountdrugmart.pro/# discount drug mart pharmacy

MegaIndiaPharm MegaIndiaPharm reputable indian pharmacies

us pharmacy no prescription http://discountdrugmart.pro/# drug mart

canadian pharmacy no prescription needed https://discountdrugmart.pro/# no prescription pharmacy paypal

no prescription needed pharmacy: canadian prescription pharmacy – discount drug mart

Slot dengan fitur interaktif semakin banyak tersedia http://slotdemo.auction/# Slot dengan pembayaran tinggi selalu diminati

п»їKasino di Indonesia sangat populer di kalangan wisatawan https://garuda888.top/# Slot dengan grafis 3D sangat mengesankan

http://slot88.company/# Slot menjadi daya tarik utama di kasino

garuda888 garuda888 Slot menjadi bagian penting dari industri kasino

Slot menawarkan berbagai jenis permainan bonus https://preman69.tech/# Slot menjadi daya tarik utama di kasino

Pemain bisa menikmati slot dari kenyamanan rumah: preman69 slot – preman69

Kasino menawarkan pengalaman bermain yang seru https://slotdemo.auction/# Slot dengan grafis 3D sangat mengesankan

http://bonaslot.site/# Slot dengan tema budaya lokal menarik perhatian

Mesin slot digital semakin banyak diminati https://slotdemo.auction/# п»їKasino di Indonesia sangat populer di kalangan wisatawan

Slot klasik tetap menjadi favorit banyak orang: preman69 slot – preman69.tech

preman69.tech preman69 slot Slot menawarkan kesenangan yang mudah diakses

http://bonaslot.site/# Kasino mendukung permainan bertanggung jawab

Mesin slot menawarkan pengalaman bermain yang cepat http://slot88.company/# Permainan slot bisa dimainkan dengan berbagai taruhan

Pemain sering berbagi tips untuk menang: garuda888 – garuda888.top

http://bonaslot.site/# Kasino di Indonesia menyediakan hiburan yang beragam

Mesin slot digital semakin banyak diminati: slot 88 – slot 88

https://preman69.tech/# Permainan slot bisa dimainkan dengan berbagai taruhan

Kasino di Jakarta memiliki berbagai pilihan permainan http://preman69.tech/# Slot menjadi daya tarik utama di kasino

Slot klasik tetap menjadi favorit banyak orang https://bonaslot.site/# Slot klasik tetap menjadi favorit banyak orang

Mesin slot menawarkan berbagai tema menarik: demo slot pg – slot demo

Slot dengan pembayaran tinggi selalu diminati https://preman69.tech/# Jackpot progresif menarik banyak pemain

http://garuda888.top/# Mesin slot menawarkan pengalaman bermain yang cepat

bonaslot bonaslot Pemain harus memahami aturan masing-masing mesin

Slot menawarkan berbagai jenis permainan bonus https://slot88.company/# Mesin slot sering diperbarui dengan game baru

https://slot88.company/# Banyak pemain berusaha untuk mendapatkan jackpot

Jackpot progresif menarik banyak pemain https://slotdemo.auction/# Banyak kasino menawarkan permainan langsung yang seru

Banyak pemain mencari mesin dengan RTP tinggi: slot demo gratis – slot demo

http://garuda888.top/# Keseruan bermain slot selalu menggoda para pemain

Bermain slot bisa menjadi pengalaman sosial http://slot88.company/# Beberapa kasino memiliki area khusus untuk slot

Kasino sering mengadakan turnamen slot menarik: preman69 – preman69.tech

preman69 preman69 Banyak pemain menikmati jackpot harian di slot

https://garuda888.top/# Kasino memiliki suasana yang energik dan menyenangkan

Slot dengan tema film terkenal menarik banyak perhatian https://preman69.tech/# Permainan slot mudah dipahami dan menyenangkan

Slot dengan grafis 3D sangat mengesankan: garuda888.top – garuda888 slot

http://slotdemo.auction/# Pemain sering berbagi tips untuk menang

Mesin slot baru selalu menarik minat https://slot88.company/# Kasino di Jakarta memiliki berbagai pilihan permainan

Bermain slot bisa menjadi pengalaman sosial: BonaSlot – bonaslot

https://bonaslot.site/# Banyak pemain mencari mesin dengan RTP tinggi

bonaslot.site bonaslot Mesin slot menawarkan berbagai tema menarik

Slot menawarkan berbagai jenis permainan bonus https://slotdemo.auction/# Banyak pemain menikmati bermain slot secara online

Slot dengan pembayaran tinggi selalu diminati: slot88 – slot88.company

http://preman69.tech/# Permainan slot mudah dipahami dan menyenangkan

Banyak pemain menikmati bermain slot secara online http://slotdemo.auction/# Mesin slot sering diperbarui dengan game baru

Banyak pemain berusaha untuk mendapatkan jackpot: preman69 – preman69

Kasino di Jakarta memiliki berbagai pilihan permainan http://slotdemo.auction/# Mesin slot baru selalu menarik minat

https://slotdemo.auction/# Mesin slot baru selalu menarik minat

garuda888.top garuda888.top Banyak kasino memiliki promosi untuk slot

Mesin slot digital semakin banyak diminati https://slotdemo.auction/# Jackpot progresif menarik banyak pemain

Kasino mendukung permainan bertanggung jawab: preman69 – preman69

http://garuda888.top/# Banyak pemain berusaha untuk mendapatkan jackpot

Slot dengan fitur interaktif semakin banyak tersedia http://slot88.company/# Banyak kasino menawarkan permainan langsung yang seru

https://slotdemo.auction/# Pemain sering berbagi tips untuk menang

Banyak kasino memiliki promosi untuk slot: slot demo rupiah – slot demo

Kasino di Jakarta memiliki berbagai pilihan permainan https://slotdemo.auction/# Banyak kasino memiliki promosi untuk slot

slot demo rupiah slot demo gratis Slot menawarkan kesenangan yang mudah diakses

https://slotdemo.auction/# Mesin slot digital semakin banyak diminati

Jackpot progresif menarik banyak pemain: preman69 slot – preman69 slot

Slot menjadi bagian penting dari industri kasino https://slot88.company/# Kasino sering mengadakan turnamen slot menarik

https://bonaslot.site/# Kasino menyediakan layanan pelanggan yang baik

Mesin slot menawarkan pengalaman bermain yang cepat: slot88.company – slot 88

Slot menawarkan berbagai jenis permainan bonus http://bonaslot.site/# Banyak pemain berusaha untuk mendapatkan jackpot

slot 88 slot88 Banyak kasino memiliki program loyalitas untuk pemain