Filing your taxes through online services is a new concept, and it has become a more popular method of filing your IRS taxes. Filing our own taxes can be quite the hassle. Doing all the calculations and constant trips to the IRS and every step of the process taking forever to complete, the entire process is enough to drive people crazy. But. These online options are not always cheap and can cost more than an average taxpayer might want to pay.

The E-file.com IRS tax filing service can help the average taxpayer pay their taxes smartly, conveniently, and securely. This E-file review contains information regarding the E-file.com website, such as how it works, what services E-file.com provides, and how it can benefit the average taxpayer.

| Name | E-File |

| Purpose | Providing tax preparation services and cloud tax preparation software. |

| Benefits | ● Seamless user inteface

● Provides tons of important features ● Offers 100% free options ● Provides live chat support to premium subscribers |

| Federal Price | Starts at $0 |

| State Price | Starts at $0 |

| DIY Filing Price | Starts at $0 – $54.95 |

| Where to Buy | E-File Official Website (E-file.com) |

| Name of the Company | E-File.com LLC. |

What is E-file?

E-file is software designed to help average taxpayers file their taxes virtually and conveniently. The service offers an intuitive guidance system and an interface free from clutters that helps taxpayers complete their taxes faster. You have to keep in mind some extra steps when filing activities related to investments.

Every subsection of the E-file.com service starts with a brief questionnaire asking some primary questions regarding your life and living conditions. The website then runs your information through the system and suggests you’re the best-suited schedules and forms for you.

The E-file.com service offers free filing options with restrictions to file federal taxes. The users must pay a small fee to file state taxes; the free options on the website only are for W2 income people and for Rebate Recovery Credit.

To file deductions and credits such as Child Tax Credit and HSA will require you to take a premium subscription. Getting free E-file.com services can be hard for many people; this is why it is wise to take the premium subscription from the start.

How does E-file.com work?

The E-file.com service works by eliminating the guesswork part of the tax filing process. The tax-paying software is designed to act as a guide to help you navigate through the complex tax filing process without any hassle. The E-file.com service also helps to prepare your tax papers the correct way, and if you’re are owed a refund, you can select your own method of receiving the money!

You probably know how irritating being on a regular hour-long call can be with the IRS while spending most of it on hold. E-file.com’s team of customer support agents is available to help the customer with their questions within minutes.

The E-file software also helps customers get their tax returns quicker than ever before. It’s not only that the E-file tax service makes the entire process more accessible and easier for the users to file their tax returns, but the service also delivers your tax refund faster well.

The E-file software delivers your federal tax refund quicker than any other tax filing service anywhere because of the E-filing program by the IRS itself. If you file your taxes online with IRS, then your refund will be sent directly to your bank account.

Does E-file work?

The E-file software really does work. If registered with the IRS, the website makes the entire process safer and more trustworthy. There are currently thousands of taxpayers all over the United States who are using the services offered by the IRS.

The E-file software helps the average taxpayer efficiently navigate through the maze of tax filing. This service has already become an in-demand service among the taxpayers. Real users of the software have testified themselves that the E-file service has helped them save money while paying their taxes without any added hassle or extra money.

Who owns E-file?

The E-file.com service is an online IRS E-file providing company-owned and operated by TaxWork LLC. TaxWork LLC is known for its premium taxing solution and its convenient technologies.

The company is registered in the United States and has its office in Venice, FL.

What are the benefits of using the E-file.com service?

It can clearly be understood that there are numerous benefits of using a software service like E-file.com. But to give the readers a better understanding of the benefits they can enjoy when they start using the E-file.com service are as follows:

- No federal cost: The tax filing process for filing taxes are free for all to use. But it is more preferred by the people who have W2 level income.

- Very low federal cost: Even though there is a small fee for filing state taxes, the fee is very low and affordable compared to other taxing services.

- Pay with tax refund: Through the E-file website, users can pay for their taxes with their tax refunds which are not allowed everywhere.

- Provides audit support: the E-file.com software provides the customers with all the support they might need to audit their income taxes and helps to conclude the process as smoothly as possible.

- Tax pros support: There are teams of tax experts known as tax pros to support you every step of the way.

- Print tax returns: The E-file software lets you print out your tax returns for safekeeping or official needs.

- Previous returns: You can import information from the previous year’s tax returns to the current year if you’re a returning user of E-file.com.

- For Self-employment: If you buy the premium E-file.com plan, you can file taxes for your self-employment incomes, something that not all tax filing services let customers do.

- Breakdown deductions: The E-file services break down your tax deductions and list them so that you can use the information when needed.

- Deduction of charities: The E-file software helps the customer deduct their charitable donations from their taxes very easily, making the process much more convenient for the customers.

- Web software: Because the service is on the web, a customer can log into the website any time they like and get their taxes filed in a quarter of the time it takes to do it manually.

The benefits of E-file.com software are not only limited to the benefits mentioned above but there are other wide-ranging benefits of using E-file that you can enjoy only from the website and nowhere else.

What are the Pros and cons of E-file?

Through a pros and cons list, we can know what benefits a certain thing can provide and how it stands in contrast to the negative side. To give the readers of this E-file review, we have prepared a list of pros and cons of using the E-file software.

E-file pros and cons are as follows:

Pros:

- File your taxes faster than before.

- E-file.com makes the entire process more convenient.

- The tax guides help you to make better decisions.

- Dedicated tax pros help you in our decision-making process.

- All calculations are done digitally.

- Federal tax filing is free for anyone with W2 income.

- The subscriptions are very affordable.

- Freedom to choose between three affordable packages.

- One-stop solution for tax filing.

Cons:

- New users may find the software a bit hard to navigate through.

- The free package has restrictions.

How to get E-file.com subscription?

Getting an E-file is very easy for anyone with at least a W2 income. You have to choose between three packages, one of which is free but with restrictions. To get your own E-file.com subscription, you will first have to visit the E-file website and apply for the subscription you prefer. After that, the software will ask you some basic questions about your life and the life you live, and after processing all your information, the website will accept you as a user.

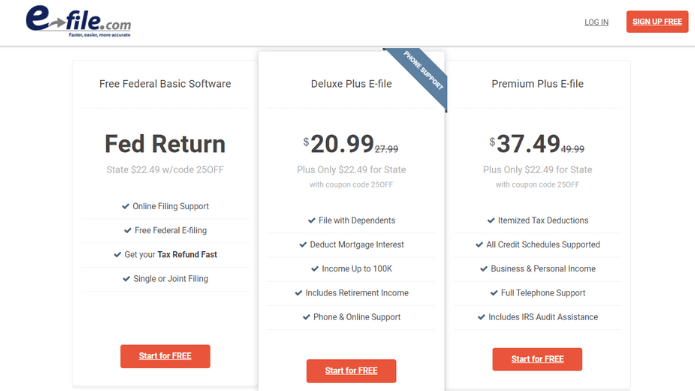

Every package on the E-file website is much more affordable than any other online tax filing service. A customer can choose between three packages on the E-file website. These packages offer benefits that you can enjoy only by being subscribed to the E-file.com website.

How much does E-file cost?

Compared to its competitors, such as Turbotax and others like it, the E-file service costs are lower. The people who have used the E-file website have testified that their services are premium and deliver on their promises.

The customers will find three packages when they visit the E-file.com website. Each package included in the E-file website is cheap and offers quality services that they can actually provide.

The E-file.com packages and their prices are as follows:

Free Federal package: Joint and single filers are appropriate for the free federal package with no dependents and without filing extra schedules. Your federal tax returns are under the free federal plan. The plan for state taxes usually costs $25. You can also get 25% off for only $22.49.

Deluxe plus package: Joint and single filers are more appropriate for this package, along with mortgage interests, dependents, and even retirement income. The price for federal tax returns in the Deluxe plus package is worth $27.99, and state returns usually cost $25. Using the code 25OFF, you can get the package for a 25% discount for $20.49 and $22.49.

Premium package: people with moderate and complicated taxing circumstances should use the premium package from E-file.com. The package includes income from investments, small businesses, self-employment income, and property incomes. The usual federal price for the premium package is $49.99, and the state tax return price is $25. With the 25OFF code, you can get 25% off on both the packages with their prices reduced as much as $10 to $8.

E-file.com user testimonials and customer reviews

The E-file.com tax services are currently being used by thousands of people all over the country, all of whom are more than satisfied with the service they are receiving. This part of the E-file review contains E-file customer reviews and testimonials shared by real users of the E-file.com service. This is to give our readers an insight into how the E-file experience really is.

E-file customer reviews are as follows:

- “I have a very busy schedule because of work, and I barely ever got the time to give some time to my family, let alone do my taxes all day. The E-file service has helped me tremendously in this regard. E-file has made filing my tax returns very convenient; it provides convenience so that doing my taxes doesn’t even feel like a chore anymore, and it is because of the E-file website.” Matthew. T. 35.

- “The deluxe edition of the E-file website has really saved me a lot of hassle. I used to have to stay on call with the IRS for hours on my phone because of just one little query. But since I started using the E-file deluxe plus edition it has made my life much easier and I am not confused at all when I am filing my tax returns.” Stephaney. S. 40.

- “I used to panic when I used to sit down to do my taxes as I didn’t understand anything I was looking at. I knew that I was losing money, and I had to pay them no matter what. The E-file taxing software really changed it all for me. I am using the premium package right now, and I can do all the complex tax calculations without dropping a sweat.” Kith. F. 30.

E-file Review: conclusion

One of the reasons many people try to avoid paying taxes is that it’s a very tricky chore. Not everyone understands how the taxing system is in the United States, and most people don’t get the time to sit down and work on their taxes the entire day. If you’re not a professional tax advisor or tax lawyer, all the complex calculations, loopholes, and predatory behaviors can’t be avoided. But even if everyone doesn’t understand the process, everyone has to pay their share of taxes.

In this E-file review, we have how this revolutionary new software can make the lives of the average taxpayer much easier and more convenient. With its expert analysis, the software can also help the customer save as much money as possible while paying their due tax.

So, in conclusion, the E-file software is a huge step toward taking tax filing into a new era.

E-file.com FAQs

Are e-file services legit?

Yes, all E-file.com services are totally legitimate. Through E-file.com, you can file your federal taxes completely legitimately and without hassle.

Is e file legit?

The E-file.com software is legit, and it has made filing taxes much easier some might say E-file.com has brought filing taxes into the digital age.

Is e-file.com safe?

The E-file.com website is completely safe, and all transactions are done through encrypted pathways. The website is an accredited online tax filing service, which means you can always trust it.

Is e file free?

Some E-file.com services are free, but some have to be unlocked through subscription packages. You can file your federal taxes free through the E-file.com website, but the state taxes will require a subscription.

Is e-file the IRS tax site?

Even though E-file.com is acknowledged by the IRS and anyone with simple taxes can file their IRS taxes from it, it is not the official IRS tax filing site; the official IRS tax filing site files.

Is e-file secure?

E-file.com is very secure and can be used to pay federal taxes by anyone with simple taxes to file. All transactions are made through secure encrypted methods and are approved by the IRS.

What do I do if I can’t e file taxes?

If you can’t file your taxes on E-file.com, you can contact the #-file.com help section, and you will be able to navigate through the process and safely file your taxes.

How do I get my e file 2019 tax return?

If you had filed your taxes a year before the current year, you can send all your information to the current year’s tax file and get the returns.

Why can’t I e-file TurboTax?

Turbotax is a similar service to E-file.com. You can file your taxes on TurboTax as well as Efile.com. But in comparison, e-file.com is much more efficient and cost-friendly than TurboTax.

How do I get returns from e file 2020 taxes?

If you can’t get your returns from your 202 taxes, you can transfer all the information to the E-file.com website and get your 2020 tax returns.

Why can’t e file earn income credit?

To file your earned income credit, you will need to have simple tax filing credentials, and you will need to have at least W2 income to use the E-file.com services.

How do E-file Income Tax Returns work?

If you have prior tax knowledge and know what you’re doing in filing taxes, then E-file.com is the best solution for you. The service offers three DIY services to file your tax returns which we explained in this review on E-file.

Also Read: SUPREME KETO ACV GUMMIES REVIEW