Introduction:

According to the United Nations Food and Agriculture Department, 342 million tonnes of meat from land animals were consumed globally in 2018. There are 8 billion people on Earth, and each year, 73 billion land animals are slaughtered for meat. The world population is expected to exceed 10 billion by 2050, tripling current meat consumption. Feeding this population with conventional meat is not environmentally sustainable because increased meat production necessitates more water and green land, as well as more greenhouse gas emissions.

Cellular Agriculture combines biotechnology and food sciences to generate animal products such as eggs, dairy, and meat from animal cells rather than animals. Meat produced from cells extracted from living and healthy animals and grown in a controlled environment is referred to as cultured meat, cultivated meat, or lab-grown meat. Cultured meat is a sustainable solution to meet our future meat demands because of its advantages over conventional meat, such as no need to kill animals, low environmental impact, and use of less resources.

Despite the fact that plant-based meat alternatives have been on the EU and US markets for a few years, cultured meat products are only available in Singapore following the historic regulatory approval of Eat Just’s cultivated chicken. By the end of 2023, other regions are anticipated to follow suit.

According to Biotech Forecasts, the global cultured meat market is estimated to reach USD 3.4 Billion by 2030, with an annual growth rate of 44.08% from 2022 to 2030.

The market is expanding as a result of rising government support for alternative proteins and rising investment in cultured meat. Growing public awareness increased animal welfare concerns, and developing concerns about the environmental impact of conventional meat are other factors driving the market’s expansion. But the high cost associated with the process, as well as ethical and social issues, can prevent the industry from expanding. Cultured Meat has enormous promise for transforming the present meat business, with several global meat and food companies, like JBS, Tyson Foods, and Nestle, investing extensively

Cultured Meat Process:

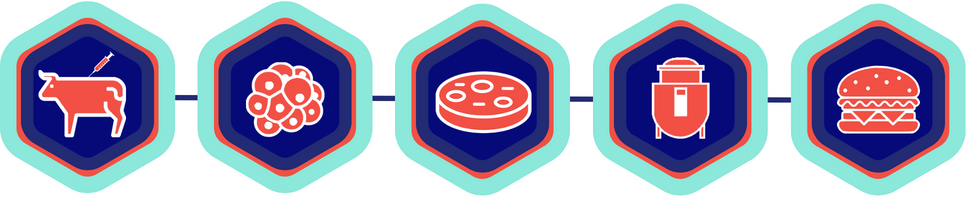

The process starts with the biopsy of live, healthy animals to obtain a sample of their cells. The cells are then grown in cell culture medium with necessary nutrition’s. After a few days, the cells are placed in a bioreactor where the necessary oxygen and temperature are supplied to the cells for exponential growth into the necessary thickness of tissues, and after the harvesting process, the cells are ready to be used as a meat product.

Historical Timeline:

- 1912: Alexis Carrel demonstrated to keep a piece of chick heart muscle alive in a Petri dish.

- 1931: Winston Churchill published his thoughts on cultivated meat in strand magazine.

- 1950: Willem van Eelen recognizes the possibility of generating meat from tissue culture.

- 1971: Russell Ross achieves the in vitro cultivation of muscular fibers.

- 1995: US. FDA approved the use of commercial in vitro meat production techniques.

- 1999: Willem van Eelen secures the first cultured meat patent entitled “Industrial Production of Meat Using Cell Culture Methods”.

- 2001: NASA begins in vitro meat experiments, producing cultured turkey meat.

- 2002: Morris Benjamin developed world’s first Edible Cultured Meat Sample produced from goldfish cells.

- 2003: Oron and Lonat exhibits Steak made from frog cells at International Biological Art Exhibition.

- 2004: John F Vein secures patent for entitled “Method for producing tissue engineered meat for consumption”.

- 2005: Henk Haagsman received a €2 Million grant from Dutch Govt. for study in vitro meat development using stem cells.

- 2008: PETA the animal right nonprofit organization announced to give $1 million to the initial company that could bring lab-grown chicken.

- 2009: Time magazine labels cultured meat as one of the breakthrough concepts of the year.

- 2013: Mark Post unveiled the world’s first hamburger made from lab-grown cultivated meat at a press conference in London.

- 2015: Maastricht University conducted its first International Conference on Cultured Meat.

- 2016: Memphis Meats (now Upside Foods) announced to create the world’s first meatballs created from cultivated chicken meat.

- 2016: Super Meat start a crowd funding campaign for bringing lab-grown poultry products to the market.

- 2017: Finless Foods anticipate to bring sustainable, lab-grown seafood to customer markets within two years.

- 2018: Alpeh Farms unveiled the World’s First 3D Bioprinted Beef Steak made from cultured cells.

- 2020: Eat Just Singapore becomes the first country to regulate the market approval for cultivated Meat made by Eat Just.

- 2021: Tufts University awarded $10 million by the USDA to establish the National Institute for Cellular Agriculture.

- 2021: Future Meat Technologies raised the industry largest $347 million in a series B funding round led by ADM Ventures and joined by Tyson Foods Venture arm.

- 2021: Upside Foods opens its production facility with a capacity of 50,000 pounds of cultivated meat per year.

- 2022: Upside Foods raised the massive $400 million in a Series C funding round led by the capital firm Temasek, and Abu Dhabi Growth Fund.

Competitive Landscape:

The competitive landscape in the Cultured Meat Market comprises at least 100+ market rivals offering a variety of products and services, such as cultured meat end products, bioprocess, cell culture growth media, and 3D Bio-printing Services.

- Eat Just Inc., becomes the first company to get Singapore Government market approval to sell its cultivated chicken products as an ingredient to a Singapore restaurant.

- Upside Foods, formerly Memphis Meats, is a US-based food-tech startup developing cultivated meat using its proprietary animal-free serum technology. It recently raised the industry’s largest $400 million and opened a 53,000 Sq ft production plant facility with a 50,000-pound annual production capacity.

- Future Meat Technologies develops cultured chicken products and is the first company to use unique cell culture medium recycling technology to cut production costs to $7.70 per pound, or $1.70 per 110-gram chicken breast. It secured $347 million from ADM and Tyson Ventures in 2021.

- Aleph Farms is an Israel-based startup that unveiled the world’s first 3D Bioprinted beef steak made from cultivated meat.

- Mosa Meat is a Dutch firm founded by Dr. Mark Post, who debuted the world’s first hamburger made from cultured meat during a press conference in London in 2013.

Regulatory Landscape:

USA: The USDA, or US Department of Agriculture, is in charge of developing regulations for Cultivated Meat in the United States. Although it has not yet published any recommendations for cultivated meat approval, it has made several steps toward cultivated meat regulatory approval. For example, the USDA awarded Tufts University $10 million in 2021 to establish a cellular agricultural centre of excellence. Furthermore, the National Institutes of Health awarded Defined USA Bioscience $1.5 million to develop a cell culture media supplement.

UK: The UK Food Standards Agency (FSA) is in charge of providing market permission to any cultured meat product application following a risk assessment approach based on various aspects of EU food safety rules. The UK Government invests on lab grown meat in 2021. For example, Multus Media received a £106,000 grant from Innovate UK, a government-funded public organization, in 2021 for developing low-cost cell growth media. In addition, the UK government awarded Roslin Technologies a £1 million funding to produce stem cell lines for cultured meat companies.

EU: After a risk assessment procedure, the European Food Safety Authority (EFSA) in the EU is responsible for providing market permission to any cultured meat product application. In 2021, the EU and its member nations will have made significant investments in cellular agriculture and Cultivated Meat. Mosa Meat and partner Nutreco got a €2 million funding from the React-EU initiative in 2021 to produce low-cost growth medium. Furthermore, Horizon Europe issued three requests for proposals totaling € 32 million in R&D into alternative proteins, including cultured meat, in June 2021.

China: China spends almost £10 billion annually for meat imports to feed its 1.5 billion people, and it is making great strides toward cultured and lab-grown meat. China signed a $300 million contract with three Israeli cultured meat companies to supply lab-grown beef in 2017. China is likewise attempting to develop its own cultured meat industry. For example, China’s Ministry of Science and Technology will undertake a $93 million R&D initiative named “Green Biological Manufacturing” in 2020. Furthermore, in December 2021, China unveiled its five-year strategy for cultured meat.

Japan: In Japan, the Ministry of Health, Labor, and Welfare (MHLW) is attempting to create laws and has assembled a team of experts to investigate the safety of produced cultured meat. The Japanese government collaborates with commercial enterprises to make grown meat a viable option. For example, in April 2022, Nissin Foods announced the development of the country’s first cultured meat in conjunction with the University of Tokyo. Furthermore, IntegriCulture, a Japan-based cultured meat startup, raised $7 million for the development of its CulNet System, a low-cost growing media.

Singapore: In November 2020, the Singapore Food Agency (SFA) becomes the first national regulator to grant market approval to Eat Just Inc.’s Cultivated Chicken for use as an ingredient in 1880 Restaurant chicken bits. Later in 2021, SFA will also grant Eat Just market approval for other cultured meat product, including lab grown chicken breast. SFA gave scientific manufacturing firm Esco Astro a license to manufacture cultured meat in July 2021. With these favorable developments, Singapore becomes the Hub for cultivated meat, and other companies can create and market their products in the country.

Brazil: In Brazil, the National Health Agency’s General Food Office (ANVISA) will be in charge of examining applications for approval of cultured meat products. ANVISA is establishing a regulatory framework for cultured meat and intends to follow a similar framework that will be followed by other regions such as the United States and Europe. Brazil, the world’s largest beef exporter, is keen on beef-related cultured meat products. For example, BRF, Brazil’s and the world’s largest meat exporter, recently announced a collaboration agreement with Israel-based Aleph Farms to develop and market 3D Bio-printed Cultivated Beef Steak in Brazil.

Israel: The National Food Control Service department of the Ministry of Health in Israel is in charge of receiving and analyzing applications for cultured meat products. Because of the Israeli government’s initiatives, Israel leads the region in terms of investment and number of enterprises. For example, Israeli Prime Minister Benjamin Netanyahu became the first head of government to try a cultured meat product created by Israeli Aleph Farms in December 2020. Furthermore, in October 2021, the Israel Innovation Authority announced a $69 million investment in four new innovative consortia, including a cultured meat consortium managed by Israel’s largest meat company, Tnuva.

Conclusion:

With technological advancements such as 3D Bioprinting, cell sourcing, and finding alternatives to growing cells without the use of Serum such as Fetal Bovine Serum (FBS), cultured meat will soon replace conventional meat, and we will see lab grown chicken nuggets, kebabs, and burger patties in the frozen section of department stores. It is expected that by 2050, cultured meat will account for nearly 50% of all meat consumed.