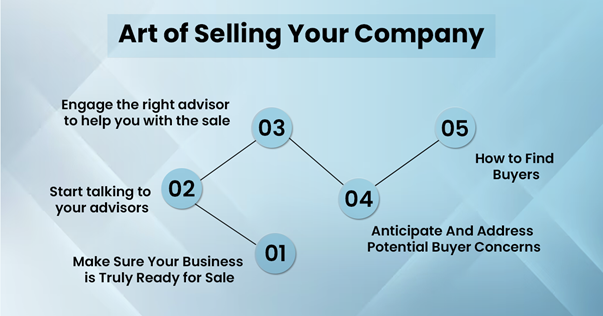

Many successful businesses are taken over by the founder’s family or by existing management team (management buyout). But there are times when you may need to look for external buyers. Regardless of why you may want to sell your business there are a number of steps you need to take to ensure you extract the maximum value for what you have built. Afshin Ardalan, a business advisor based in Vancouver, recommends following these steps.

1. Make Sure Your Business is Truly Ready for Sale

Many businesses are highly reliant on their founders. Take away the founder and the business will struggle and may even crumble. Savvy buyers will recognize this and will walk away or offer an inferior price for the business. If you are not convinced your business is able to survive and thrive without your continued presence, this is where you need to start as it will typically take at least a year or more to fix this problem.

To address this, you need to ensure:

- All key business processes are thoroughly documented, and you have standard operating procedures (SOP) for all the areas of the business.

- You have recruited and trained a core group of middle managers capable of running the business without you.

- You have instilled a culture of continuous improvement among all employees. This means your employees are motivated to constantly look for ways of improving the operations- on their own initiative.

If any of these are missing from your business, now is the time to act. It is sometimes a good idea to enlist the help of consultants as part of this process. When it’s time to sell, consultant fees will be more than they pay for themselves. Vancouver-based Wardell International helps business owners systematize and improve their operations.

2. Start talking to your advisors

If you’re considering selling, your accountants and lawyers should be the first to know. Selling your business can have significant and unexpected tax implications. To properly plan for a sale, sometimes it is necessary to make changes in the corporate structure a few years in advance.

I’ve seen cases where a nearly $20M sale had a tax bill of less than $500k due to proper planning. This is why you need to ensure you consult with your accountants, lawyers, and other advisors well in advance of any sale.

3. Engage the right advisor to help you with the sale

While it may be tempting to sell the business on your own to save on fees, most experts agree you can derive the most value from your business if you hire professionals to help you with the sales. Business brokers and consultants specializing in Mergers and Acquisitions (M&A) buy and sell businesses for a living and will be able to provide you with guidance and advice that can far outweigh any fees they may charge you.

4. Anticipate And Address Potential Buyer Concerns

You can make the entire process of making a sale go more quickly and without any hiccups if you put yourself in the position of the buyer and proactively address any problems that may arise. Here are some of the points you should think through:

- The asking price: common methods to arrive at a valuation include discounted cashflow, or comparable transactions. Often the size of the deal dictates the valuation method used, with the larger deals involving more complex valuation methodologies. Regardless of which method is used, make sure you are prepared to justify the asking price.

- Financing method: This will depend on the size of the transaction, and typically the larger the transaction, the more complex the financing structure. How willing you are to provide vendor financing for a portion of the sale price can make the process easier for potential buyers and increase the likelihood of closing the deal.

- Risk: This will be a key concern for any buyers as they will assess your business as they would assess any other investment. They will consider the risks and rewards. What risks would the buyers subject themselves to? These could be company specific risks or risks specific to your sector of activity. By proactively considering these risks and putting in place mitigation measures, you will be able to alleviate the buyer’s concerns and make the process smoother for both parties.

5. How to Find Buyers

Depending on the deal size, many buyers would approach business brokers, accountants, or M&A advisors they already know. Likewise, you can put out the word through many of the same intermediaries. As many acquisitions occur in the same industry, you can also spread the word.

Of course, you’ll need to balance the need to sell with the potential disruption to your business if your employees find out. Afshin Ardalan says: Selling your business may seem daunting at first. But if you approach it as a process with well-defined steps, you can remove many obstacles in advance and make it an interesting rather than stressful experience.